18+ Tech debt to equity ratio ideas in 2021

Home » techno Info » 18+ Tech debt to equity ratio ideas in 2021Your Tech debt to equity ratio images are ready. Tech debt to equity ratio are a topic that is being searched for and liked by netizens now. You can Get the Tech debt to equity ratio files here. Find and Download all royalty-free images.

If you’re searching for tech debt to equity ratio images information related to the tech debt to equity ratio keyword, you have come to the right site. Our site always gives you hints for viewing the maximum quality video and image content, please kindly search and find more informative video articles and images that match your interests.

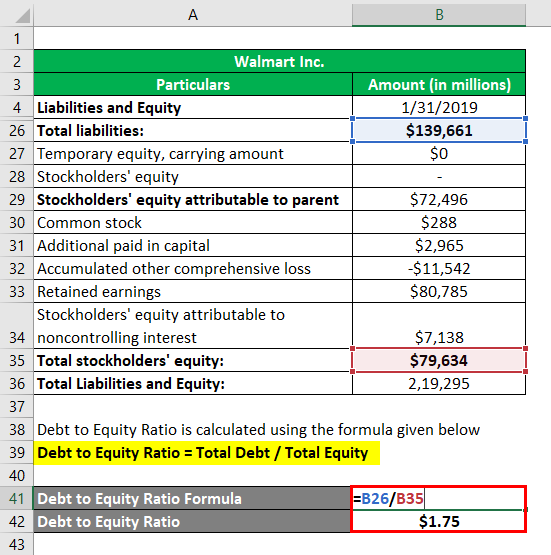

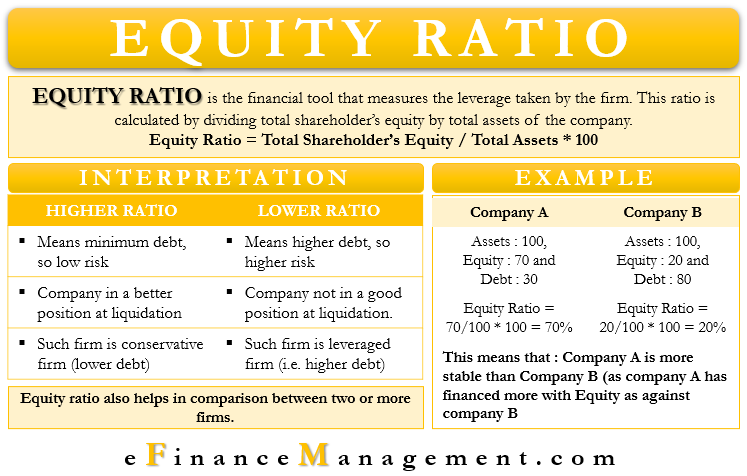

Tech Debt To Equity Ratio. On the trailing twelve months basis Technology Sectors Cash cash equivalent grew by 941 in the 1 Q 2021 sequentially faster than Current Liabilities this led to improvement in Technology Sectors Quick Ratio to 106 in the 1 Q 2021 Quick Ratio remained below Technology Sector average. Debt-to-equity ratio is the key financial ratio and is used as a standard for judging a companys financial standing. As of 2020 the debt ratio of the. A high debt to equity ratio generally means that a company has been aggressive in financing its growth with debt.

Debt Equity Ratio Definition And Meaning Market Business News From marketbusinessnews.com

Debt Equity Ratio Definition And Meaning Market Business News From marketbusinessnews.com

HCL Technologiess debt to equity for the quarter that ended in Mar. Current and historical debt to equity ratio values for Tetra Tech TTEK over the last 10 years. A high debt to equity ratio generally means that a company has been aggressive in financing its growth with debt. Ratios higher than 2 are generally unfavorable. The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity. Debt to Equity Ratio Definition.

A ratio lower than 1 is considered favorable since that indicates a company is relying more on equity than on debt to finance its operating costs.

Tetra Tech debtequity for the three months ending March 31 2021 was 021. The debt-to-equity ratio debtequity ratio DE is a financial ratio indicating the relative proportion of entitys equity and debt used to finance an entitys assets. This statistic displays the ratio of total debt and total assets of the global technology industry from 2007 to 2020. Current and historical debt to equity ratio values for Tetra Tech TTEK over the last 10 years. Debt-to-equity ratio is the key financial ratio and is used as a standard for judging a companys financial standing. 125 rows The debtequity ratio can be defined as a measure of a companys financial leverage.

Source: investopedia.com

This statistic displays the ratio of total debt and total assets of the global technology industry from 2007 to 2020. As of 2020 the debt ratio of the. A high debt to equity ratio generally means that a company has been aggressive in financing its growth with debt. Debt to Equity Ratio Definition. On the trailing twelve months basis Technology Sectors Cash cash equivalent grew by 941 in the 1 Q 2021 sequentially faster than Current Liabilities this led to improvement in Technology Sectors Quick Ratio to 106 in the 1 Q 2021 Quick Ratio remained below Technology Sector average.

Source: wikihow.com

Source: wikihow.com

Published by Shanhong Liu Jan 20 2021. 125 rows The debtequity ratio can be defined as a measure of a companys financial leverage. Debt to Equity Ratio Definition. Tetra Tech debtequity for the three months ending March 31 2021 was 021. 2021 was 011.

Source: pinterest.com

Source: pinterest.com

2021 was 011. Current and historical debt to equity ratio values for Tetra Tech TTEK over the last 10 years. Published by Shanhong Liu Jan 20 2021. 125 rows The debtequity ratio can be defined as a measure of a companys financial leverage. This metric is useful when analyzing the health of a companys balance sheet.

Source: educba.com

Source: educba.com

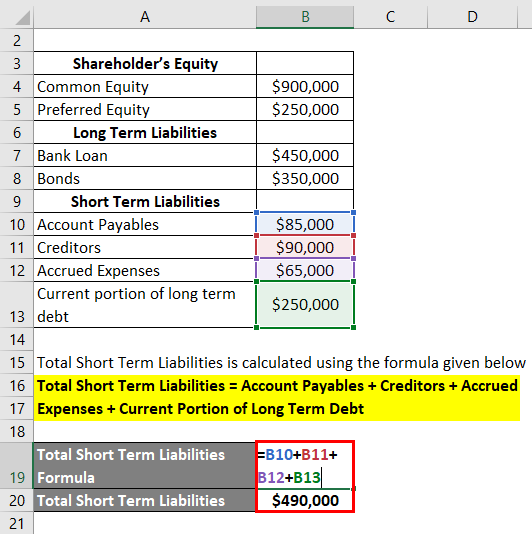

Current and historical debt to equity ratio values for Tetra Tech TTEK over the last 10 years. Raytheon Technologies Debt to Equity Ratio. 75 rows Debt-to-equity ratio - breakdown by industry Debt-to-equity ratio is a financial ratio. Debt to Equity Ratio Definition. The debt to equity ratio measures the Long Term Debt Current Portion of Long Term Debt Total Shareholders Equity.

Source: efinancemanagement.com

Source: efinancemanagement.com

This statistic displays the ratio of total debt and total assets of the global technology industry from 2007 to 2020. Current and historical debt to equity ratio values for Tetra Tech TTEK over the last 10 years. The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity. Raytheon Technologies Debt to Equity Ratio. Debt to Equity Ratio Definition.

Source: quora.com

Current and historical debt to equity ratio values for Tetra Tech TTEK over the last 10 years. A ratio lower than 1 is considered favorable since that indicates a company is relying more on equity than on debt to finance its operating costs. 125 rows The debtequity ratio can be defined as a measure of a companys financial leverage. Debt-to-equity ratio is the key financial ratio and is used as a standard for judging a companys financial standing. Debt to Equity Ratio Definition.

Source: wikihow.com

Source: wikihow.com

The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity. This metric is useful when analyzing the health of a companys balance sheet. In simple words it is the ratio of the total liabilities of a company and its shareholders equity. Published by Shanhong Liu Jan 20 2021. This statistic displays the ratio of total debt and total assets of the global technology industry from 2007 to 2020.

Source: educba.com

Source: educba.com

Ratios higher than 2 are generally unfavorable. The debt-to-equity ratio debtequity ratio DE is a financial ratio indicating the relative proportion of entitys equity and debt used to finance an entitys assets. The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity. Raytheon Technologies debtequity for the three months ending March 31 2021 was 041. 2021 was 011.

Source: investopedia.com

Source: investopedia.com

Raytheon Technologies Debt to Equity Ratio. Ratios higher than 2 are generally unfavorable. Raytheon Technologies debtequity for the three months ending March 31 2021 was 041. This ratio is also known as financial leverage. The debt to equity ratio measures the Long Term Debt Current Portion of Long Term Debt Total Shareholders Equity.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

The Debt to Equity DE ratio is a straightforward metric that calculates the proportion of the debt of a company relative to its equity. Published by Shanhong Liu Jan 20 2021. As of 2020 the debt ratio of the. In simple words it is the ratio of the total liabilities of a company and its shareholders equity. Debt to Equity Ratio Definition.

Source: educba.com

Source: educba.com

The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity. Current and historical debt to equity ratio values for Tetra Tech TTEK over the last 10 years. It is one of the most. A high debt to equity ratio generally means that a company has been aggressive in financing its growth with debt. The debt to equity ratio measures the Long Term Debt Current Portion of Long Term Debt Total Shareholders Equity.

Source: wikihow.com

Source: wikihow.com

Current and historical debt to equity ratio values for Tetra Tech TTEK over the last 10 years. Published by Shanhong Liu Jan 20 2021. On the trailing twelve months basis Technology Sectors Cash cash equivalent grew by 941 in the 1 Q 2021 sequentially faster than Current Liabilities this led to improvement in Technology Sectors Quick Ratio to 106 in the 1 Q 2021 Quick Ratio remained below Technology Sector average. The debt-to-equity ratio is a financial leverage ratio which is frequently calculated and analyzed that compares a companys total liabilities to its shareholder equity. Current and historical debt to equity ratio values for Tetra Tech TTEK over the last 10 years.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title tech debt to equity ratio by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.