15+ Tech company valuation methods info

Home » techno Info » 15+ Tech company valuation methods infoYour Tech company valuation methods images are available. Tech company valuation methods are a topic that is being searched for and liked by netizens today. You can Get the Tech company valuation methods files here. Download all free images.

If you’re searching for tech company valuation methods pictures information linked to the tech company valuation methods keyword, you have pay a visit to the right blog. Our site frequently provides you with suggestions for seeking the highest quality video and picture content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

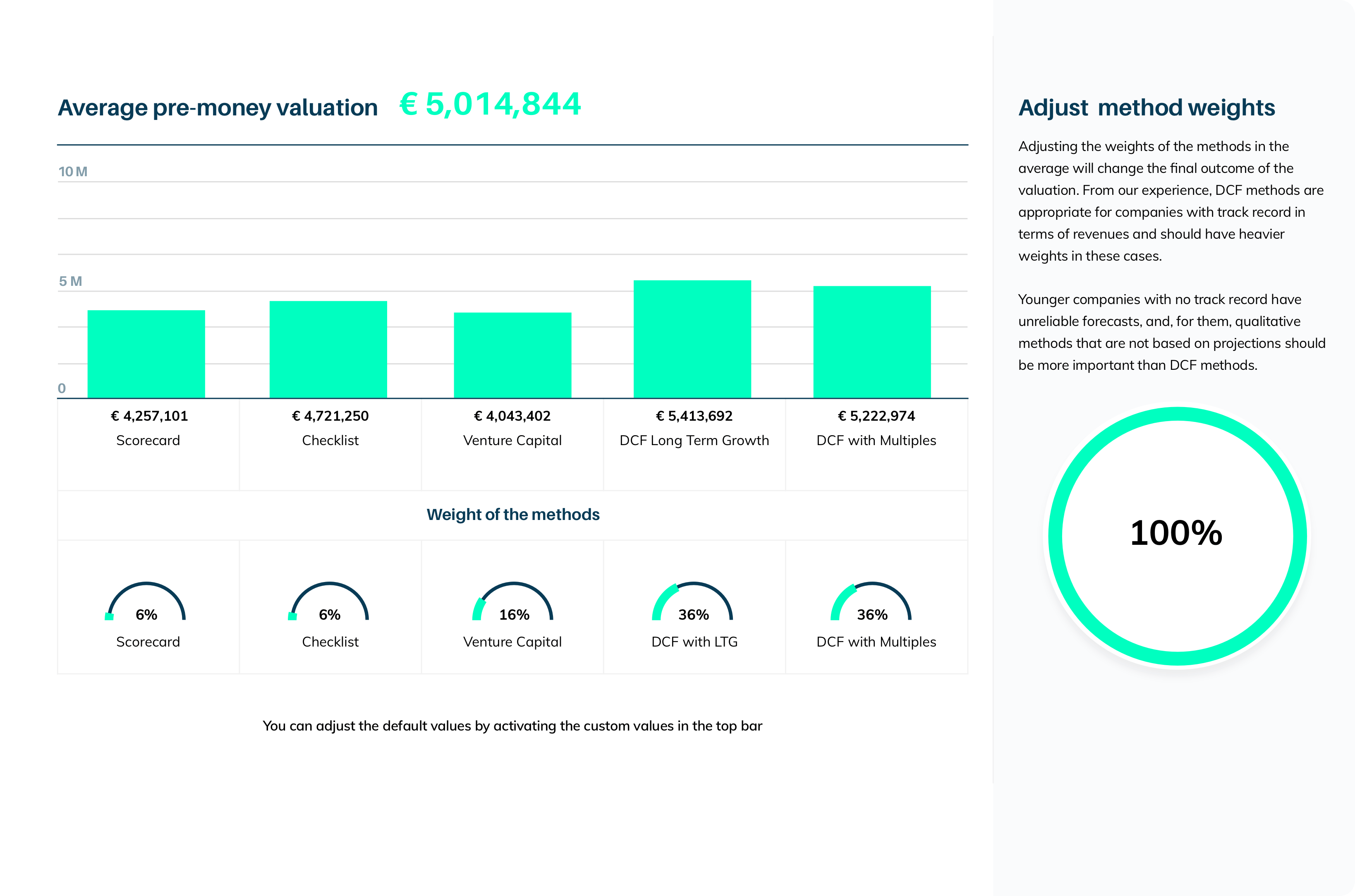

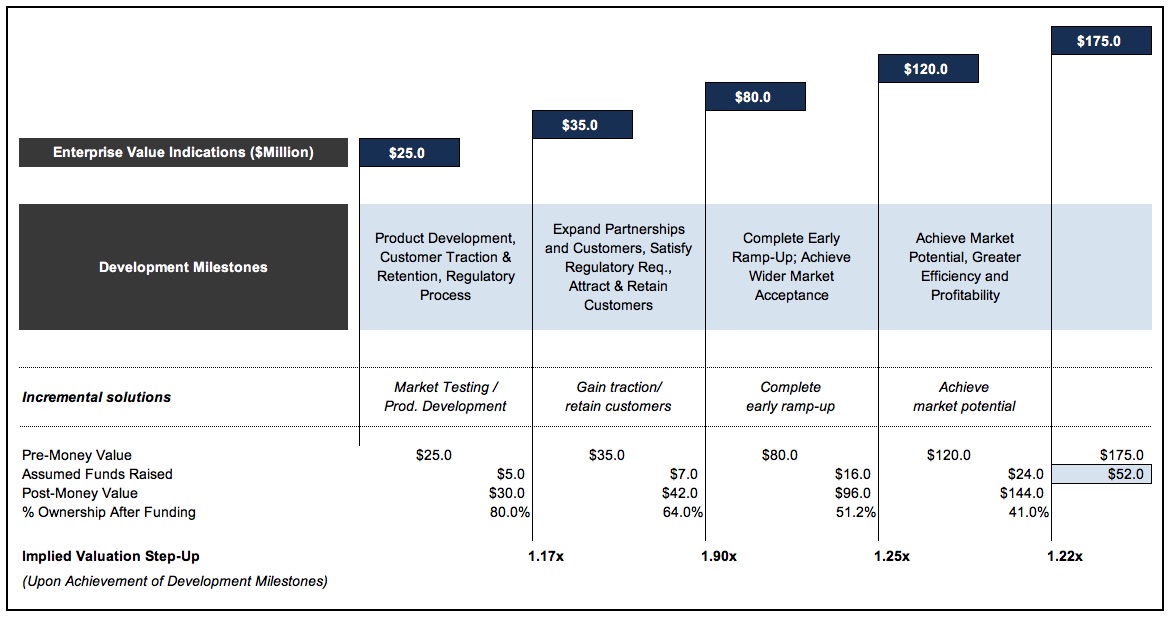

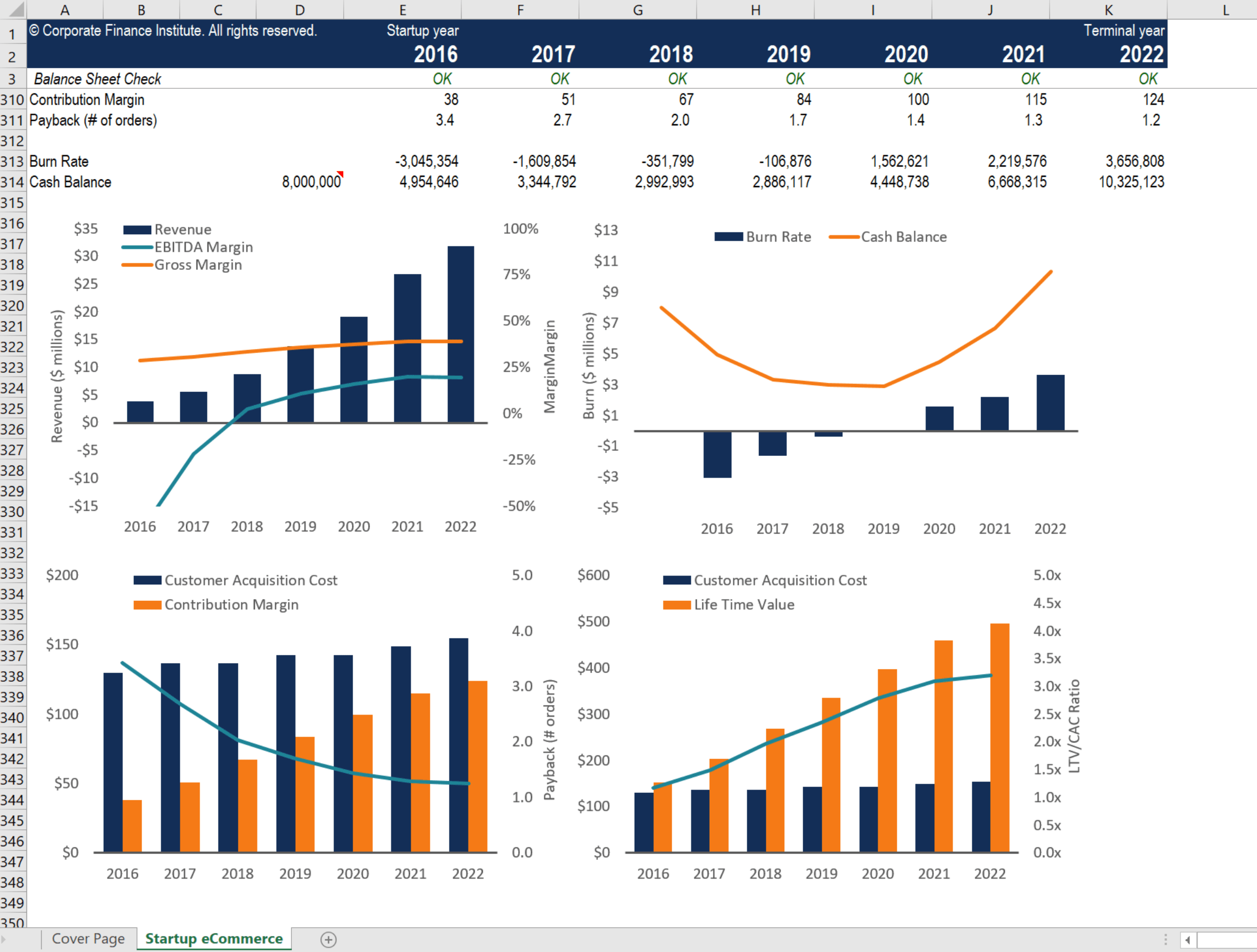

Tech Company Valuation Methods. Replacement Cost Premise ii. The commonly used methods of valuation can be grouped into one of three general approaches as follows. See multiples and ratios. 1 DCF analysis 2 comparable company analysis and 3 precedent transactions.

Startup Company Valuation Methods Ppt Powerpoint Presentation Slides Demonstration Cpb Pdf Powerpoint Templates From slidegeeks.com

Startup Company Valuation Methods Ppt Powerpoint Presentation Slides Demonstration Cpb Pdf Powerpoint Templates From slidegeeks.com

Price-to-earnings PE ratio comparable. Request your PitchBook free trial to see how our global data will benefit you. Going Concern Premise 2. A company may bid for another competitor that could potentially become a threat to its existence ie. When valuing a company as a going concern there are three main valuation methods used by industry practitioners. Request your PitchBook free trial to see how our global data will benefit you.

When valuing a company as a going concern there are three main valuation methods used by industry practitioners.

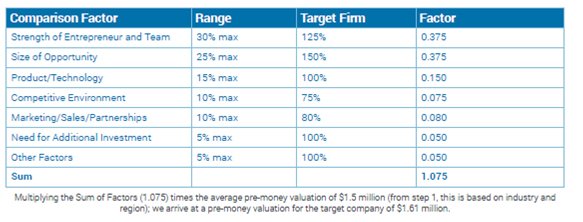

Asset Based Approach a. Has an exciting business idea or business plan. Facebooks takeover of WhatsApp and put its business model in danger. In profit multiplier the value of the business is calculated by multiplying its profit. PE multiples of future earnings per share EPS is another common method of valuing companies. Capitalization of EarningsCash Flows Method b.

Source: pro-business-plans.medium.com

Source: pro-business-plans.medium.com

Asset Based Approach a. When valuing a company as a going concern there are three main valuation methods used by industry practitioners. A company may bid for another competitor that could potentially become a threat to its existence ie. Ad See the value of a company before and after a round of funding. 1 DCF analysis 2 comparable company analysis and 3 precedent transactions.

Source: fullstack.com.au

Source: fullstack.com.au

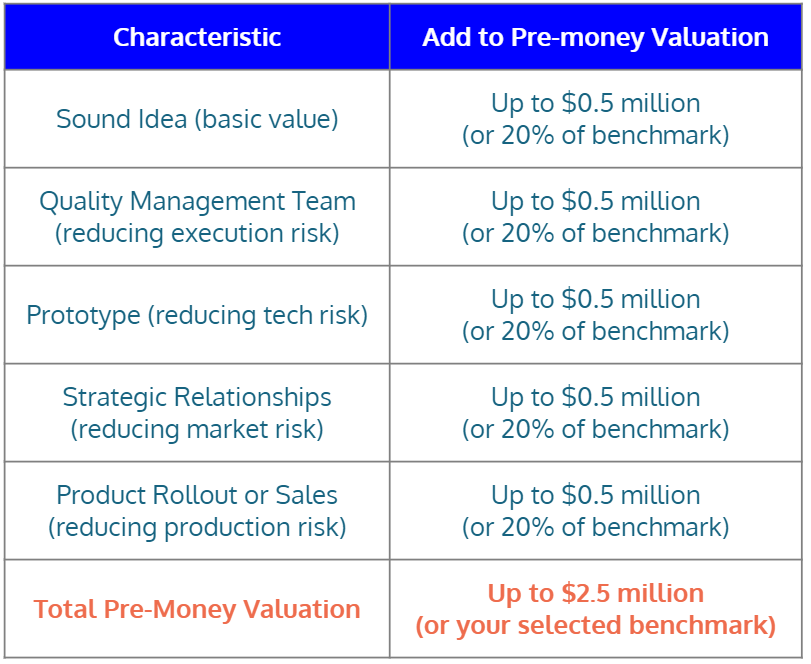

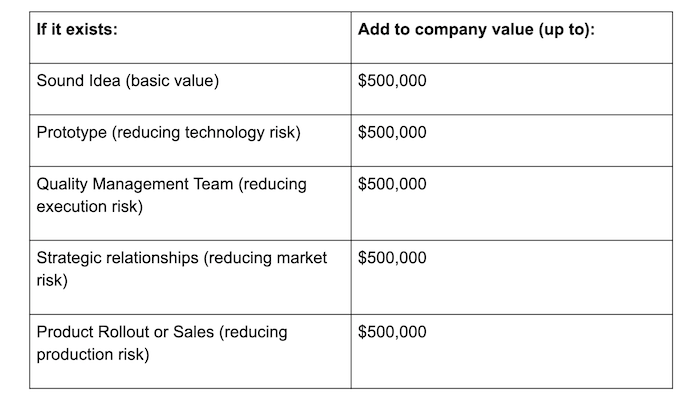

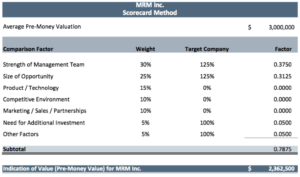

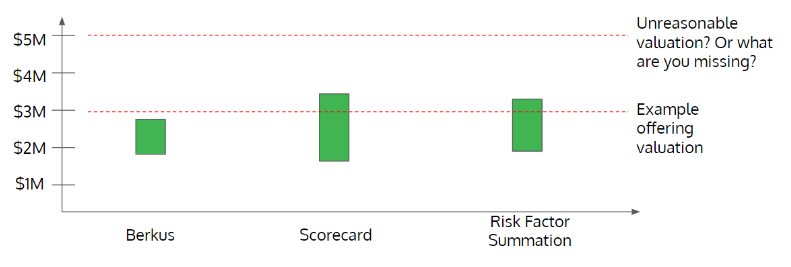

Request your PitchBook free trial to see how our global data will benefit you. Request your PitchBook free trial to see how our global data will benefit you. Has an exciting business idea or business plan. 500000 - 1 million. Risk Factor Summation Method.

Source: crowdwise.org

Source: crowdwise.org

Capitalization of EarningsCash Flows Method b. Ad See the value of a company before and after a round of funding. Has a strong management team in place to execute on the plan. For example if your companys adjusted net profit is 100000 per year and you use a multiple like 4 then the value of the business will be calculated as 4 x 100000 400000. Ad See the value of a company before and after a round of funding.

Source: equidam.com

Source: equidam.com

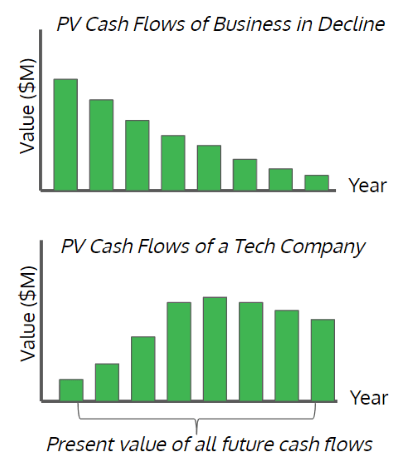

Estimated Company Value. A company may bid for another competitor that could potentially become a threat to its existence ie. Discounted Cash Flow Method. Book Value Method b. Replacement Cost Premise ii.

Source: crowdwise.org

Source: crowdwise.org

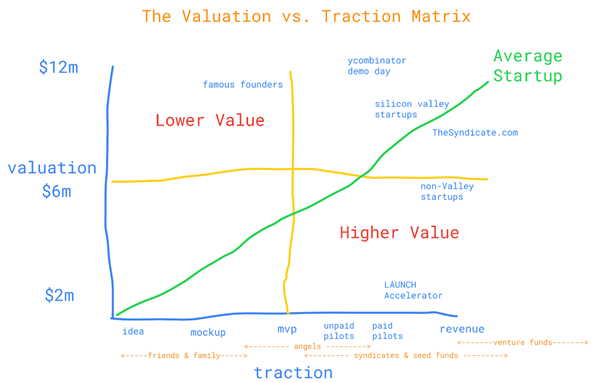

There are many different methods used in deciding on a startups valuation while all of them differ in some way they are all good to use. Risk Factor Summation Method. A company may bid for another competitor that could potentially become a threat to its existence ie. Ad See the value of a company before and after a round of funding. Discounted Cash Flow Method.

Source: mercercapital.com

Source: mercercapital.com

1 DCF analysis 2 comparable company analysis and 3 precedent transactions. Facebooks takeover of WhatsApp and put its business model in danger. Discounted Cash Flow Method. The Most Popular Startup Valuation Methods. Asset Based Approach a.

Source: slidegeeks.com

Source: slidegeeks.com

The Most Popular Startup Valuation Methods. 1 DCF analysis 2 comparable company analysis and 3 precedent transactions. For example if your companys adjusted net profit is 100000 per year and you use a multiple like 4 then the value of the business will be calculated as 4 x 100000 400000. Request your PitchBook free trial to see how our global data will benefit you. Risk Factor Summation Method.

Source: brex.com

Source: brex.com

Price-to-earnings PE ratio comparable. Ad See the value of a company before and after a round of funding. When valuing a company as a going concern there are three main valuation methods used by industry practitioners. Capitalization of EarningsCash Flows Method b. Has a strong management team in place to execute on the plan.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

In profit multiplier the value of the business is calculated by multiplying its profit. Has an exciting business idea or business plan. Valuation By Stage Method. 1 DCF analysis 2 comparable company analysis and 3 precedent transactions. Book Value Method b.

Source: bcgvaluations.com

Source: bcgvaluations.com

Estimated Company Value. See multiples and ratios. 500000 - 1 million. PE multiples of future earnings per share EPS is another common method of valuing companies. Price-to-earnings PE ratio comparable.

Source: crowdwise.org

Source: crowdwise.org

1 DCF analysis 2 comparable company analysis and 3 precedent transactions. See multiples and ratios. The Most Popular Startup Valuation Methods. Facebooks takeover of WhatsApp and put its business model in danger. Request your PitchBook free trial to see how our global data will benefit you.

Source: eloquens.com

Source: eloquens.com

Request your PitchBook free trial to see how our global data will benefit you. Price-to-earnings PE ratio comparable. In profit multiplier the value of the business is calculated by multiplying its profit. Going Concern Premise 2. Replacement Cost Premise ii.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tech company valuation methods by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.