11++ Tech company pe ratio ideas

Home » techno idea » 11++ Tech company pe ratio ideasYour Tech company pe ratio images are ready. Tech company pe ratio are a topic that is being searched for and liked by netizens today. You can Get the Tech company pe ratio files here. Get all royalty-free photos.

If you’re looking for tech company pe ratio pictures information related to the tech company pe ratio keyword, you have visit the right blog. Our site always gives you hints for seeking the highest quality video and image content, please kindly search and locate more enlightening video content and images that match your interests.

Tech Company Pe Ratio. The company has an impressive earnings surprise history. 98 rows Current PE. Its displayed as a percentage. It beat the Streets EPS estimates in three of the trailing four quarters.

Should I Buy A Stock If It S Pe Ratio Is Negative Quora From quora.com

A lot of technology companies have a high PE ratio and in the long run those numbers make sense. 98 rows Current PE. CompaniesIf the Shiller PE ratio of a sector is lower than its historical average this might indicate that the sector is currently undervalued and vice versa. The PEG ratio is used to determine a stocks value based on trailing earnings while also taking the companys future earnings growth into account and is considered to provide a more complete. According to the Peter Lynch earnings line the stock has a fair value of 2910 while trading at 1628. At the same time the usual assumption is that additional sales go directly to profit.

The overall CAPE of the US.

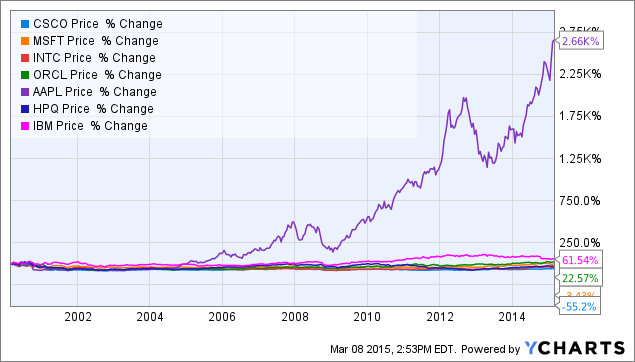

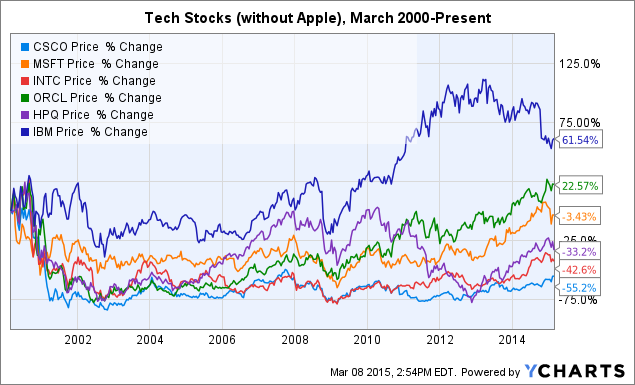

It beat the Streets EPS estimates in three of the trailing four quarters. He compared Facebooks PE ratio based on 2013 earnings estimates to Amazons Googles Apples and a few other tech companies. The company has an impressive earnings surprise history. The stock has gained 299 over the past six months. Tech stocks with good growth prospects usually trade at a higher PE price-to-earnings ratio than the broader SP 500 which is why they are considered relatively expensive. At the same time the usual assumption is that additional sales go directly to profit.

Source: quora.com

Source: quora.com

Intel Corporation Intel is the worlds largest semiconductor manufacturer and one of the more reliable clue chips in the tech sector. Tech stocks with good growth prospects usually trade at a higher PE price-to-earnings ratio than the broader SP 500 which is why they are considered relatively expensive. The stock has gained 299 over the past six months. Aggregate Mkt Cap Net Income all firms Aggregate. 103 rows This page lists companies that have unusually high price-to-earnings ratios PE Ratios.

Source: investmentzen.com

Source: investmentzen.com

In general tech companies are viewed as having high growth. Quarter 2021 for Technology Sector Price to Sales ratio is at 606 Price to Cash flow ratio is at 1785 and Price to. Tech stocks with good growth prospects usually trade at a higher PE price-to-earnings ratio than the broader SP 500 which is why they are considered relatively expensive. Aggregate Mkt Cap Net Income all firms Aggregate. Interestingly enough according to our Zacks Sector Rank data the broad Computer and Technology sector has an average PE ratio of 2108 which is.

Source: fool.com

Source: fool.com

It beat the Streets EPS estimates in three of the trailing four quarters. According to the Peter Lynch earnings line the stock has a fair value of 2910 while trading at 1628. The table below lists the current historical CAPE ratios by Sector calculated using the 500 largest public US. Intel Corporation Intel is the worlds largest semiconductor manufacturer and one of the more reliable clue chips in the tech sector. Its shares are trading with a price-earnings ratio of 838 and a price-book ratio of 054.

Source: globaldata.com

Source: globaldata.com

The stock is still overvalued argues our own Henry Blodget. Software Programming Industrys current Price to earnings ratio has increased due to shareprice growth of 612 from beginning of the first quarter and despite net income for the trailig twelve month period increase of 906 quarter on quarter to Pe of 3764 from average the Price to earnings ratio in the forth quarter of 3454. He compared Facebooks PE ratio based on 2013 earnings estimates to Amazons Googles Apples and a few other tech companies. A lot of technology companies have a high PE ratio and in the long run those numbers make sense. Its current PE ratio is 103 which means its relative PE based on its historical average is 71.

Source: quora.com

The company has an impressive earnings surprise history. Aggregate Mkt Cap Net Income all firms Aggregate. The table below lists the current historical CAPE ratios by Sector calculated using the 500 largest public US. Price to Earning ratio is at 4083 in the 1. A lot of technology companies have a high PE ratio and in the long run those numbers make sense.

Source: quora.com

Source: quora.com

This isnt the case for every tech company. A consensus EPS estimate of 029 for the current quarter represents a 190 improvement year-over-year. The stock has gained 299 over the past six months. The stock is still overvalued argues our own Henry Blodget. For example the median PE ratio for Amazon over the last 13 years is 145.

Source: seekingalpha.com

Source: seekingalpha.com

For example the median PE ratio for Amazon over the last 13 years is 145. The companys trailing 12-month PE is an impressive 12. Its current PE ratio is 103 which means its relative PE based on its historical average is 71. At the same time the usual assumption is that additional sales go directly to profit. Software Programming Industrys current Price to earnings ratio has increased due to shareprice growth of 612 from beginning of the first quarter and despite net income for the trailig twelve month period increase of 906 quarter on quarter to Pe of 3764 from average the Price to earnings ratio in the forth quarter of 3454.

Source: globaldata.com

Source: globaldata.com

Quarter 2021 for Technology Sector Price to Sales ratio is at 606 Price to Cash flow ratio is at 1785 and Price to. Quarter 2021 for Technology Sector Price to Sales ratio is at 606 Price to Cash flow ratio is at 1785 and Price to. Its current PE ratio is 103 which means its relative PE based on its historical average is 71. A lot of technology companies have a high PE ratio and in the long run those numbers make sense. Aggregate Mkt Cap Net Income all firms Aggregate.

Source: investopedia.com

In the case of a company like Microsoft. Quarter 2021 for Technology Sector Price to Sales ratio is at 606 Price to Cash flow ratio is at 1785 and Price to. Interestingly enough according to our Zacks Sector Rank data the broad Computer and Technology sector has an average PE ratio of 2108 which is. According to the Peter Lynch earnings line the stock has a fair value of 2910 while trading at 1628. Aggregate Mkt Cap Net Income all firms Aggregate.

Source: theedgemarkets.com

Source: theedgemarkets.com

Its displayed as a percentage. Price-to-earnings ratio of major software companies worldwide 2019 Published by Shanhong Liu Jul 31 2020 Salesforce leads the chart with a price-to-earnings PE ratio of 2011. Price to Earning ratio is at 4083 in the 1. The PE ratio is. According to the Peter Lynch earnings line the stock has a fair value of 2910 while trading at 1628.

Source: valuescopeinc.com

Source: valuescopeinc.com

Price-to-earnings ratio of major software companies worldwide 2019 Published by Shanhong Liu Jul 31 2020 Salesforce leads the chart with a price-to-earnings PE ratio of 2011. The companys trailing 12-month PE is an impressive 12. Its shares are trading with a price-earnings ratio of 838 and a price-book ratio of 054. Its current PE ratio is 103 which means its relative PE based on its historical average is 71. This isnt the case for every tech company.

Source: seekingalpha.com

Source: seekingalpha.com

Of course in some cases they can be a warning flag as. The PEG ratio is used to determine a stocks value based on trailing earnings while also taking the companys future earnings growth into account and is considered to provide a more complete. In general tech companies are viewed as having high growth. For example the median PE ratio for Amazon over the last 13 years is 145. Interestingly enough according to our Zacks Sector Rank data the broad Computer and Technology sector has an average PE ratio of 2108 which is.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tech company pe ratio by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.