20++ Tech company ebitda multiple info

Home » techno idea » 20++ Tech company ebitda multiple infoYour Tech company ebitda multiple images are ready in this website. Tech company ebitda multiple are a topic that is being searched for and liked by netizens today. You can Get the Tech company ebitda multiple files here. Find and Download all royalty-free vectors.

If you’re looking for tech company ebitda multiple images information connected with to the tech company ebitda multiple topic, you have come to the ideal blog. Our website always provides you with suggestions for downloading the highest quality video and picture content, please kindly search and locate more enlightening video content and graphics that match your interests.

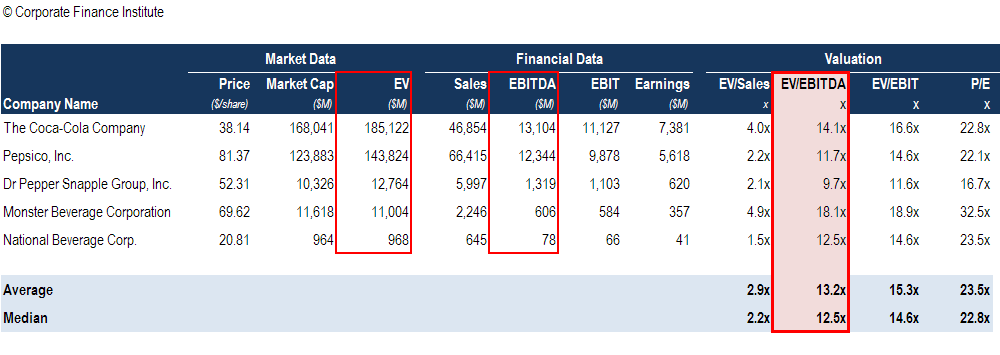

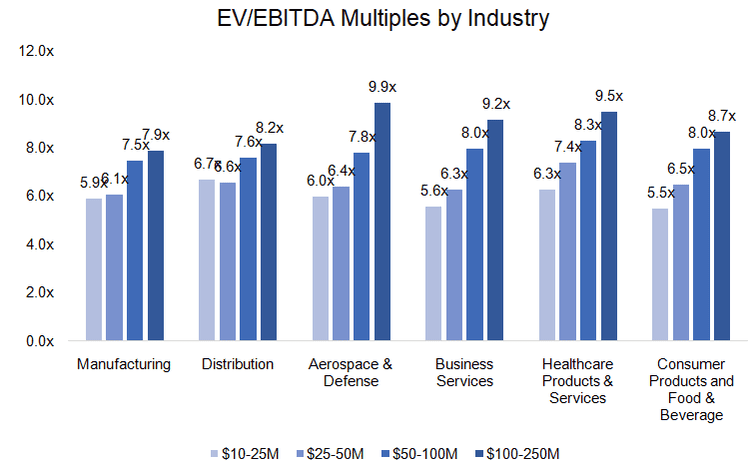

Tech Company Ebitda Multiple. This could be just a coincidence but one explanation could be that post-Covid lockdowns with people shifting their behavior to spend more time at home going forward US tech companies. Airport Operators Services. Appliances Tools Housewares. Index indicating the enterprise value EV multiples against earnings before income tax and depreciation and amortization EBITDA In this analysis we determine EV as the total of market capitalization and interest-bearing liabilities.

What S The Value Of My Business The Ins And Outs Of Ebitda Multiples Cronkhite Capital From cronkhitecapital.com

What S The Value Of My Business The Ins And Outs Of Ebitda Multiples Cronkhite Capital From cronkhitecapital.com

The highs in 2017 were 14x but a more normalized multiple historically has been around 9x. Pinterest lost more in EBITDA -14bln than it generated in revenue 12bln but still trades at 104x. Auto Truck Manufacturers. Harder for clients to leave them compared to service businesses. The median multiple is now 46x. There are also some big deals in the pipeline such as the 2b private equity MYOB takeover over which.

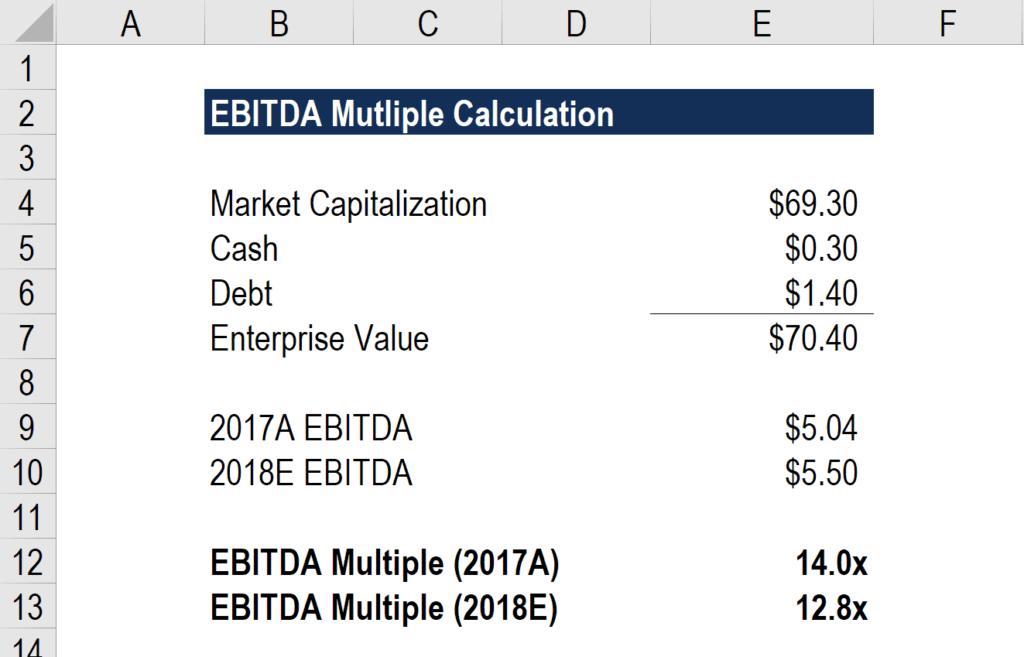

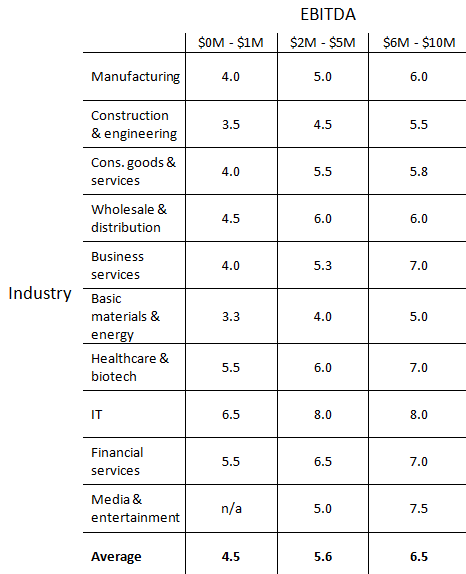

Selling price divided by EBITDA earnings before interest taxes depreciation and amortization is a commonly used valuation multiple.

Airport Operators Services. 221 rows EBITDA Multiple. EBITDA Multiple1226 959B 782B. This could be just a coincidence but one explanation could be that post-Covid lockdowns with people shifting their behavior to spend more time at home going forward US tech companies. Apples EBITDA multiple of 1226 means investors are willing to pay a premium to buy shares of the company. Airport Operators Services.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Typically SaaS companies command higher multiples PE or EBITDA due to the nature of their business being sticky ie. 98 rows Industry specific multiples are the techniques that demonstrate what business is worth. Selling price divided by EBITDA earnings before interest taxes depreciation and amortization is a commonly used valuation multiple. Published by Statista Research Department Jan 18 2021 Worldwide the average value of enterprise value to earnings before interest tax depreciation and amortization EVEBITDA in the. Harder for clients to leave them compared to service businesses.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Ad See what you can research. US Revenue and EBITDA in 2021 are higher For American tech companies revenue and EBITDA multiples both are higher in 2021 with average revenue multiple of 61x in 2021 compared to 51x in 2020 and average EBITDA multiple of 293x compared to 247x. Published by Statista Research Department Jan 18 2021 Worldwide the average value of enterprise value to earnings before interest tax depreciation and amortization EVEBITDA in the. 98 rows Industry specific multiples are the techniques that demonstrate what business is worth. Ad See what you can research.

Source: chinookadvisors.com

Source: chinookadvisors.com

The EBITDA multiple is a financial ratio that compares a companys Enterprise Value Enterprise Value EV Enterprise Value or Firm Value is the entire value of a firm equal to its equity value plus net debt plus any minority interest to its annual EBITDA EBITDA EBITDA or Earnings Before Interest Tax Depreciation Amortization is a companys profits before any. 221 rows EBITDA Multiple. Over 12 times EBITDA per share to be exact. Business Valuation Resources recently published EBITDA multiples by industry from a study of over 30000. The multiples on the table above are trailing twelve months meaning the last four quarters are used when earnings before interest taxes depreciation and amortization are calculated.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Typically SaaS companies command higher multiples PE or EBITDA due to the nature of their business being sticky ie. This could be just a coincidence but one explanation could be that post-Covid lockdowns with people shifting their behavior to spend more time at home going forward US tech companies. Selling price divided by EBITDA earnings before interest taxes depreciation and amortization is a commonly used valuation multiple. Harder for clients to leave them compared to service businesses. Apparel Accessories Retailers.

Source: microcap.co

Source: microcap.co

Auto Truck Manufacturers. Ad See what you can research. Published by Statista Research Department Jan 18 2021 Worldwide the average value of enterprise value to earnings before interest tax depreciation and amortization EVEBITDA in the. Apples EBITDA multiple of 1226 means investors are willing to pay a premium to buy shares of the company. The EBITDA multiple for a specific sector is calculated by dividing the total enterprise value of all sector companies by the total sum of annual EBITDA of the companies.

Source: microcap.co

Source: microcap.co

There are also some big deals in the pipeline such as the 2b private equity MYOB takeover over which. The multiples on the table above are trailing twelve months meaning the last four quarters are used when earnings before interest taxes depreciation and amortization are calculated. The highs in 2017 were 14x but a more normalized multiple historically has been around 9x. Come up with an industry average across peers for PE multiple EVEBITDA multiple revenue multiple and you can estimate how much your company is worth based on the industry benchmark. Traditional marketplace multiples vary widely.

Source: microcap.co

Source: microcap.co

Selling price divided by EBITDA earnings before interest taxes depreciation and amortization is a commonly used valuation multiple. Snapchat is at 177x after falling from 40x in Q4 2016 and still lost nearly 1bln in EBITDA on 18bln of revenue. The EBITDA multiple for a specific sector is calculated by dividing the total enterprise value of all sector companies by the total sum of annual EBITDA of the companies. Prior to Q3 2018 the sector only had 2 companies and now has 8. Ad See what you can research.

Source: cronkhitecapital.com

Source: cronkhitecapital.com

Ad See what you can research. 221 rows EBITDA Multiple. Ad See what you can research. What is the EBITDA Multiple. Snapchat is at 177x after falling from 40x in Q4 2016 and still lost nearly 1bln in EBITDA on 18bln of revenue.

Source: howtoplanandsellabusiness.com

Source: howtoplanandsellabusiness.com

Typically SaaS companies command higher multiples PE or EBITDA due to the nature of their business being sticky ie. The EBITDA multiple for a specific sector is calculated by dividing the total enterprise value of all sector companies by the total sum of annual EBITDA of the companies. Business Valuation Resources recently published EBITDA multiples by industry from a study of over 30000. This is higher than other companies within the Consumer Durables industry meaning investors expect Apple to grow faster than its peers. Harder for clients to leave them compared to service businesses.

Source: nashadvisory.com.au

Source: nashadvisory.com.au

Auto Truck Manufacturers. Pinterest lost more in EBITDA -14bln than it generated in revenue 12bln but still trades at 104x. The EBITDA stated is for the most recent 12-month period. Business Valuation Resources recently published EBITDA multiples by industry from a study of over 30000. Apparel Accessories Retailers.

Source: microcap.co

Source: microcap.co

Harder for clients to leave them compared to service businesses. This is higher than other companies within the Consumer Durables industry meaning investors expect Apple to grow faster than its peers. The highs in 2017 were 14x but a more normalized multiple historically has been around 9x. Airport Operators Services. Apparel Accessories Retailers.

Source: researchgate.net

Source: researchgate.net

Index indicating the enterprise value EV multiples against earnings before income tax and depreciation and amortization EBITDA In this analysis we determine EV as the total of market capitalization and interest-bearing liabilities. Published by Statista Research Department Jan 18 2021 Worldwide the average value of enterprise value to earnings before interest tax depreciation and amortization EVEBITDA in the. US Revenue and EBITDA in 2021 are higher For American tech companies revenue and EBITDA multiples both are higher in 2021 with average revenue multiple of 61x in 2021 compared to 51x in 2020 and average EBITDA multiple of 293x compared to 247x. Appliances Tools Housewares. The EBITDA multiple for a specific sector is calculated by dividing the total enterprise value of all sector companies by the total sum of annual EBITDA of the companies.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tech company ebitda multiple by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.