10++ Tech bubble recession ideas in 2021

Home » techno idea » 10++ Tech bubble recession ideas in 2021Your Tech bubble recession images are available. Tech bubble recession are a topic that is being searched for and liked by netizens today. You can Download the Tech bubble recession files here. Get all free images.

If you’re searching for tech bubble recession pictures information linked to the tech bubble recession interest, you have visit the ideal blog. Our site frequently gives you hints for viewing the maximum quality video and picture content, please kindly search and locate more enlightening video content and images that match your interests.

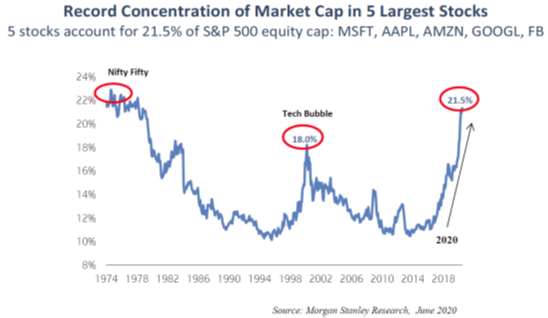

Tech Bubble Recession. To combat the early 1990s recession and savings and loan collapse the Federal Reserve dropped the fed funds target down to a low of 3. Then it kept it there for 17 months. On March 10 the combined values of stocks on the NASDAQ was at 671 trillion. Price Matters In the aftermath of the tech crash investors shifted focus to parts of the market that had been cast aside.

The Dot Com Bubble Sept 11 Sars And The Financial Crisis Allen S Thoughts From allensthoughts.com

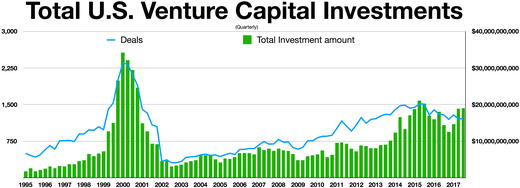

As the tech bubble deflated starting in early 2000 MA transaction volume declined alongside a slowdown in GDP growth. The dotcom bubble was a rapid rise in US. The 1995-2000 Dot-Com Bubble and Dotcom Crash did not threaten to take down the entire US. The crash began March 11. Stock market suffered one of its biggest plunges since the 2008 financial crash albeit. The dotcom tech bubble occurred in the late 1990s and ended abruptly in early 2000.

When the tech bubble burst in 2001 students began to move away from computer science which led in turn to a multiyear decline.

The only problem was the Internet wasnt an easy magical medium for making money. The remaining two Cisco Intelafter 20 yearsstill havent. In the past two decades weve experienced two gigantic asset bubbles first in tech stocks then in housing. It seems to me that the Fed was right to. 2 The bursting of the tech bubble on the. The recession affected the European Union during 2000 and 2001 and the United States from March to November 2001.

Source: alambicim.com

Source: alambicim.com

Of those names three Microsoft Oracle IBM took over a decade to reach their respective bubble-era price peaks. The 20 year anniversary of the dotcom bubble implosion this week came as the US. The recession affected the European Union during 2000 and 2001 and the United States from March to November 2001. Stock market suffered one of its biggest plunges since the 2008 financial crash albeit. In the past two decades weve experienced two gigantic asset bubbles first in tech stocks then in housing.

Source: jaredbernsteinblog.com

Source: jaredbernsteinblog.com

The causes for its downfall are numerous but evidence. Figure 3 shows the rise and fall during this cycle of history. Stock market suffered one of its biggest plunges since the 2008 financial crash albeit. The remaining two Cisco Intelafter 20 yearsstill havent. Japans 1990s recession continued.

Source: fivethirtyeight.com

Source: fivethirtyeight.com

The early 2000s recession was a decline in economic activity which mainly occurred in developed countries. The dotcom tech bubble occurred in the late 1990s and ended abruptly in early 2000. As the tech bubble deflated starting in early 2000 MA transaction volume declined alongside a slowdown in GDP growth. Price Matters In the aftermath of the tech crash investors shifted focus to parts of the market that had been cast aside. The crash began March 11.

Source: wescapgroup.com

Source: wescapgroup.com

The Tech Bubble Is About to Burst This VC Says The value of many multi-billion dollar technology companies like Uber and Snapchat will fall in the coming months. Figure 3 shows the rise and fall during this cycle of history. The housing crash killed retail spending which collapsed 8 percent from 2007 to 2009 one of the largest two-year drops in recorded American history. It was just about the US. A year after the recession stocks were about 33.

Source: investopedia.com

Source: investopedia.com

Then it kept it there for 17 months. The early 2000s recession was a decline in economic activity which mainly occurred in developed countries. Japans 1990s recession continued. On March 10 the combined values of stocks on the NASDAQ was at 671 trillion. The causes for its downfall are numerous but evidence.

Source: wikizero.com

Source: wikizero.com

The 1995-2000 Dot-Com Bubble and Dotcom Crash did not threaten to take down the entire US. It was just about the US. The dotcom tech bubble occurred in the late 1990s and ended abruptly in early 2000. Price Matters In the aftermath of the tech crash investors shifted focus to parts of the market that had been cast aside. The 2008 Financial Crisis was much worse than the 2000 Dotcom Crash.

Source: wikiwand.com

Source: wikiwand.com

As the tech bubble deflated starting in early 2000 MA transaction volume declined alongside a slowdown in GDP growth. The 1995-2000 Dot-Com Bubble and Dotcom Crash did not threaten to take down the entire US. Price Matters In the aftermath of the tech crash investors shifted focus to parts of the market that had been cast aside. Stock Market and the stock market isnt. Then it kept it there for 17 months.

Source: fivethirtyeight.com

Source: fivethirtyeight.com

2 The bursting of the tech bubble on the. Figure 3 shows the rise and fall during this cycle of history. Technology stock equity valuations fueled by investments in Internet-based companies in the late 1990s. The 1995-2000 Dot-Com Bubble and Dotcom Crash did not threaten to take down the entire US. The housing crash killed retail spending which collapsed 8 percent from 2007 to 2009 one of the largest two-year drops in recorded American history.

Source: ideas.ted.com

Source: ideas.ted.com

The dotcom bubble was a rapid rise in US. The UK Canada and Australia avoided the recession while Russia a nation that did not experience prosperity during the 1990s in fact began to recover from said situation. The dotcom bubble was a rapid rise in US. Of those names three Microsoft Oracle IBM took over a decade to reach their respective bubble-era price peaks. The causes for its downfall are numerous but evidence.

Source: blog.realinstitutoelcano.org

Source: blog.realinstitutoelcano.org

Stock Market and the stock market isnt. As the tech bubble deflated starting in early 2000 MA transaction volume declined alongside a slowdown in GDP growth. According to Dice the 2001 tech bubble recession was by far the most severe for technology professionals. It seems to me that the Fed was right to. Of those names three Microsoft Oracle IBM took over a decade to reach their respective bubble-era price peaks.

Source: allensthoughts.com

The causes for its downfall are numerous but evidence. The early 2000s recession was a decline in economic activity which mainly occurred in developed countries. Japans 1990s recession continued. The 20 year anniversary of the dotcom bubble implosion this week came as the US. It was just about the US.

Source: sites.google.com

Source: sites.google.com

Of those names three Microsoft Oracle IBM took over a decade to reach their respective bubble-era price peaks. Even today with the strong jobs. As the tech bubble deflated starting in early 2000 MA transaction volume declined alongside a slowdown in GDP growth. Figure 3 shows the rise and fall during this cycle of history. Stock market suffered one of its biggest plunges since the 2008 financial crash albeit.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tech bubble recession by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.