13++ Tech bubble loss information

Home » techno idea » 13++ Tech bubble loss informationYour Tech bubble loss images are available. Tech bubble loss are a topic that is being searched for and liked by netizens now. You can Get the Tech bubble loss files here. Download all royalty-free photos and vectors.

If you’re searching for tech bubble loss images information linked to the tech bubble loss interest, you have visit the right site. Our website always provides you with suggestions for refferencing the maximum quality video and picture content, please kindly search and find more enlightening video articles and images that match your interests.

Tech Bubble Loss. It doesnt mean that there is a stock market crash coming as the 2000s tech bubble had a pretty orderly deflation over two years. Ranked 1 was none other than Michael Saylor who had a whopping 1353 Billion LOSS. However all the latest corrections have been pretty violent with the latest example being the stock market crash of 2020 where the market dropped 35 in a. These start-ups valued at 1 billion or more have been.

Deja Vu A Tech Bubble All Over Again Nasdaq From nasdaq.com

Deja Vu A Tech Bubble All Over Again Nasdaq From nasdaq.com

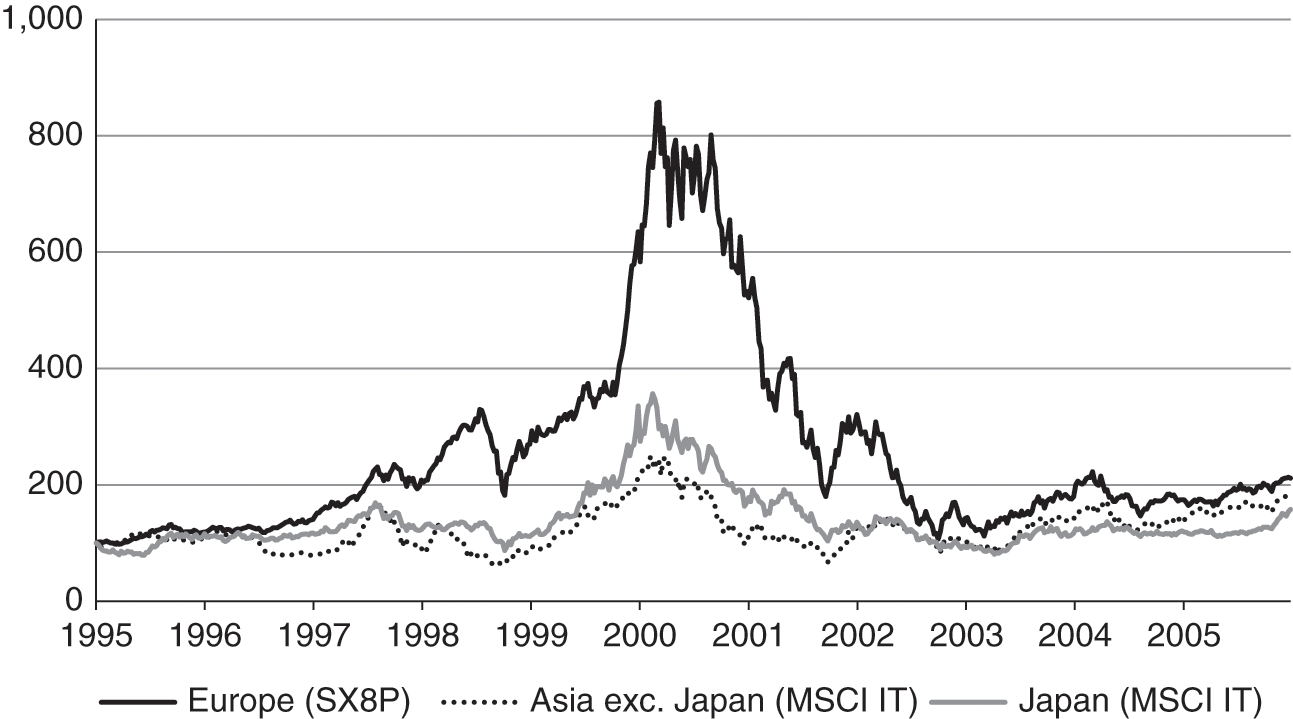

What is a tech bubble. He told us how 4 indicators have lined up for what could be the biggest loss of perceived value from assets that we have ever seen Here are some excerpts from the story. The Tech bubble and resulting stock market crash which began in 2000 and continued until 2002 is also known as the Dotcom bubble Dotcom crash Dotcom boom internet bubble and 2000 stock crash. Tech bubble refers to a pronounced and unsustainable market rise attributed to increased speculation in technology stocks. Ranked 1 was none other than Michael Saylor who had a whopping 1353 Billion LOSS. What the dotcom bubble was and how it began isnt too difficult to explain.

In 2001 Fortune Magazine published a list of the top losers of the Tech Bubble.

CNBC reported the top five tech giants lost more than 320 billion of value as a result. The cofounder of Bostons Grantham Mayo van Otterloo Co. The Tech bubble and resulting stock market crash which began in 2000 and continued until 2002 is also known as the Dotcom bubble Dotcom crash Dotcom boom internet bubble and 2000 stock crash. Elon Musk lost 163bn off his net worth as tech stocks wobbled. Many thought it would burst in 2016. Ranked 1 was none other than Michael Saylor who had a whopping 1353 Billion LOSS.

Source: seekingalpha.com

Source: seekingalpha.com

Will history repeat itself or have investors learned their lessons and its different this time. He told us how 4 indicators have lined up for what could be the biggest loss of perceived value from assets that we have ever seen Here are some excerpts from the story. Silicon Valleys technology bubble has had some of its wind knocked out. Tech bubble refers to a pronounced and unsustainable market rise attributed to increased speculation in technology stocks. Thats a 15 gain over the March 2000 record of 5132.

Source: seekingalpha.com

Source: seekingalpha.com

CNBC reported the top five tech giants lost more than 320 billion of value as a result. Tech bubble refers to a pronounced and unsustainable market rise attributed to increased speculation in technology stocks. This stirred panic among investors and the Nasdaq Index fell to 1140 by. Elon Musk lost 163bn off his net worth as tech stocks wobbled. Rapid share price growth and high valuations based on standard metrics.

Source: seekingalpha.com

Source: seekingalpha.com

Elon Musk lost 163bn off his net worth as tech stocks wobbled. Prices were already rising in the mid to late-90s but buying accelerated in late 1998. Thats a 15 gain over the March 2000 record of 5132. These start-ups valued at 1 billion or more have been. There are fewer new Silicon Valley unicorns being created.

Source: fivethirtyeight.com

Source: fivethirtyeight.com

The cofounder of Bostons Grantham Mayo van Otterloo Co. Is famous for having made prescient calls about the bursting of the 1989 Japanese asset-price bubble the 2000 tech bubble and the 2008 real-estate bubble. The dotcom disaster was a speculative bubble that covered 1995 to 2001. A technology bubble is a substantial rise and fall in the prices of assets associated with a new technology Kindleberger 1996. Will history repeat itself or have investors learned their lessons and its different this time.

Source: nasdaq.com

Source: nasdaq.com

CNBC reported the top five tech giants lost more than 320 billion of value as a result. However all the latest corrections have been pretty violent with the latest example being the stock market crash of 2020 where the market dropped 35 in a. Will history repeat itself or have investors learned their lessons and its different this time. Prices were already rising in the mid to late-90s but buying accelerated in late 1998. Quinn and Turner 2020.

Source: warriortrading.com

Source: warriortrading.com

Silicon Valley tech bubble is larger than it was in 2000 and the end is coming. Will history repeat itself or have investors learned their lessons and its different this time. Rapid share price growth and high valuations based on standard metrics. Many thought it would burst in 2016. Fears around the ongoing novel coronavirus outbreak have helped to fuel the downturn as tech.

Source: cambridge.org

Source: cambridge.org

Fears around the ongoing novel coronavirus outbreak have helped to fuel the downturn as tech. Prices were already rising in the mid to late-90s but buying accelerated in late 1998. Is famous for having made prescient calls about the bursting of the 1989 Japanese asset-price bubble the 2000 tech bubble and the 2008 real-estate bubble. These start-ups valued at 1 billion or more have been. BloombergBloomberg via Getty Images.

Source: fivethirtyeight.com

Source: fivethirtyeight.com

Prices were already rising in the mid to late-90s but buying accelerated in late 1998. What the dotcom bubble was and how it began isnt too difficult to explain. The Tech bubble and resulting stock market crash which began in 2000 and continued until 2002 is also known as the Dotcom bubble Dotcom crash Dotcom boom internet bubble and 2000 stock crash. Ranked 1 was none other than Michael Saylor who had a whopping 1353 Billion LOSS. Thats a 15 gain over the March 2000 record of 5132.

Source: cazenovecapital.com

Source: cazenovecapital.com

Elon Musk lost 163bn off his net worth as tech stocks wobbled. MicroStrategys shares went from 3300 to 4 -9999 decline and SEC even accused him of fraud. The internet bubble burst when the Fed tightened monetary policy and many leading tech companies sold their stocks. These start-ups valued at 1 billion or more have been. What is a tech bubble.

Source: ideas.ted.com

Source: ideas.ted.com

Thats a 15 gain over the March 2000 record of 5132. Is famous for having made prescient calls about the bursting of the 1989 Japanese asset-price bubble the 2000 tech bubble and the 2008 real-estate bubble. These start-ups valued at 1 billion or more have been. He told us how 4 indicators have lined up for what could be the biggest loss of perceived value from assets that we have ever seen Here are some excerpts from the story. Even today with tech stock prices still so high he said we may only be at the foothill of bubble phase.

Source: cs.stanford.edu

Source: cs.stanford.edu

These start-ups valued at 1 billion or more have been. This stirred panic among investors and the Nasdaq Index fell to 1140 by. Tech bubble refers to a pronounced and unsustainable market rise attributed to increased speculation in technology stocks. During this period Internet stocks which were both novel and difficult to value soared as investors sought. It doesnt mean that there is a stock market crash coming as the 2000s tech bubble had a pretty orderly deflation over two years.

Source: seekingalpha.com

Source: seekingalpha.com

Will history repeat itself or have investors learned their lessons and its different this time. The dotcom disaster was a speculative bubble that covered 1995 to 2001. They are generally thought to arise as a result of excitement surrounding a new technology sometimes accompanied by high initial profits which attract capital to firms that use this technology. Elon Musk lost 163bn off his net worth as tech stocks wobbled. This stirred panic among investors and the Nasdaq Index fell to 1140 by.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title tech bubble loss by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.