17+ Tech bubble bear market ideas

Home » techno idea » 17+ Tech bubble bear market ideasYour Tech bubble bear market images are available in this site. Tech bubble bear market are a topic that is being searched for and liked by netizens today. You can Get the Tech bubble bear market files here. Find and Download all royalty-free images.

If you’re looking for tech bubble bear market images information linked to the tech bubble bear market interest, you have visit the ideal blog. Our website always provides you with hints for refferencing the maximum quality video and picture content, please kindly hunt and locate more informative video content and images that match your interests.

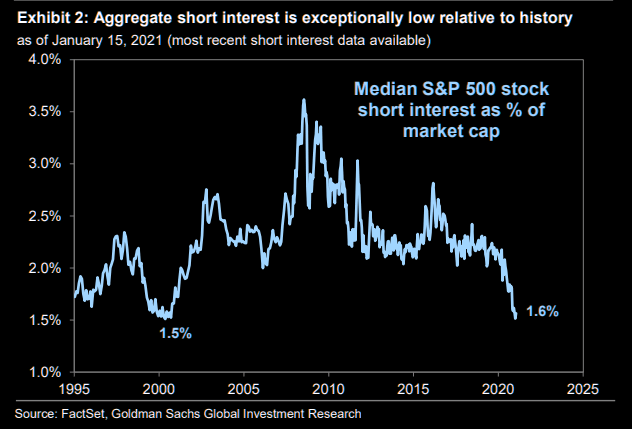

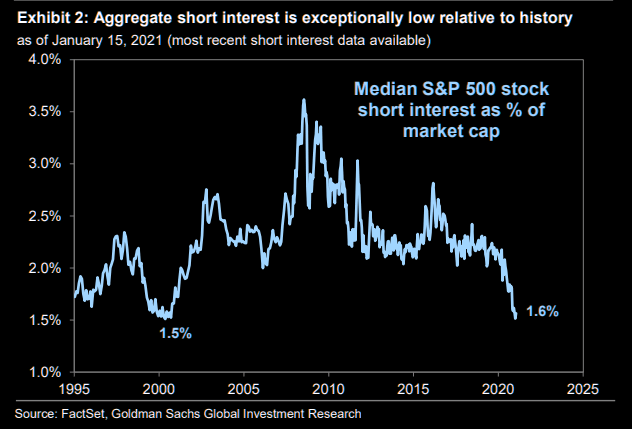

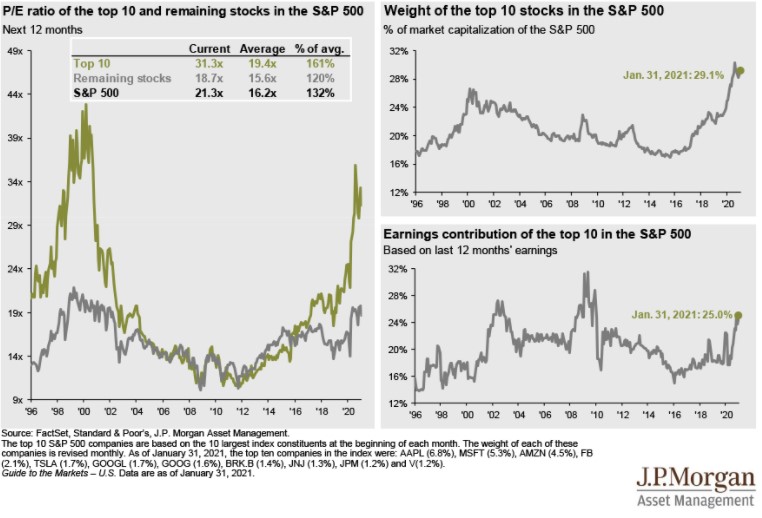

Tech Bubble Bear Market. This time around technology stocks continue to have an outside influence on the markets performance relative to the average sector but I believe it is not just sector weighting but in fact more of a market capitalization issue driven by record buybacks in the USs. As investors anticipate losses in a bear market. Robert Schiller and Fed Chairman Alan Greenspan both called the tech bubble in 1996. The 10 largest by market value are.

These Indicators Were Also Screaming At The Peak Of The Internet Bubble Seeking Alpha From seekingalpha.com

These Indicators Were Also Screaming At The Peak Of The Internet Bubble Seeking Alpha From seekingalpha.com

The divergence during the tech bubble was caused by the most extreme weighting to tech stocks ever seen in the SPs history. It was the fastest bear market ever. When the tech bubble pops the market will suffer substantially. The 1966 market was the tail end of the data processing bubble yes the 1960s had the first tech bubble. I am not saying VTV outperforms in every recession or bear market in stocks. Gladly its still early enough to participate in more upside.

Along the way the Nasdaq fell 17 three times from 1997 to 2000 without suffering a bear market.

The bubble continued until March 2000. There is still a bear market in hibernation waiting to maul investors at some unspecified time in the future. Similarly many static or strategic portfolios will also suffer and experience substantial declines because of their inability to adaptthey will reflect what the broad markets experience. But dont fall asleep thinking that it is all sunshine and rainbows for stocks SPY. This Stock Market Indicator is About to Smash The Tech Bubble Peak W. As investors anticipate losses in a bear market.

Source: alambicim.com

Source: alambicim.com

But dont fall asleep thinking that it is all sunshine and rainbows for stocks SPY. This time around technology stocks continue to have an outside influence on the markets performance relative to the average sector but I believe it is not just sector weighting but in fact more of a market capitalization issue driven by record buybacks in the USs. And that bubble he argued was most inflated in the Nasdaq 100 the tech-heavy stock index whose biggest components include Apple Amazon. The tech bubble for example peaked in March 2000 but didnt bottom until October 2002 two and a half years later. Get the full story below.

Source: seekingalpha.com

Source: seekingalpha.com

There is still a bear market in hibernation waiting to maul investors at some unspecified time in the future. Long-time market bear David Rosenberg is warning investors the stock market and bitcoin are massive bubbles. As investors anticipate losses in a bear market. We are in the midst of another tech bubble ala 1999. The black line 2020 is clearly an outlier.

Source: advisorperspectives.com

Source: advisorperspectives.com

The 10 largest by market value are. Robert Schiller and Fed Chairman Alan Greenspan both called the tech bubble in 1996. But dont fall asleep thinking that it is all sunshine and rainbows for stocks SPY. Stocks went from a peak to a trough in record time. You own some bonds and gold for that hedge.

Source: alambicim.com

Source: alambicim.com

This Stock Market Indicator is About to Smash The Tech Bubble Peak W. As of today the markets extreme overweighting in technology makes it highly vulnerable. Alongside the dot-com bubble and the housing bubble Orman sees the tech bubble. There is still a bear market in hibernation waiting to maul investors at some unspecified time in the future. The inevitable bear market that will follow the current bull market could mean that buying opportunities are more favorable further down the line.

Source: awealthofcommonsense.com

Source: awealthofcommonsense.com

Finance expert Suze Orman sees the current bull market as highly reminiscent of 2000 and 2008. Robert Schiller and Fed Chairman Alan Greenspan both called the tech bubble in 1996. Get the full story below. Alongside the dot-com bubble and the housing bubble Orman sees the tech bubble. The inevitable bear market that will follow the current bull market could mean that buying opportunities are more favorable further down the line.

Source: finsyn.com

Source: finsyn.com

The divergence during the tech bubble was caused by the most extreme weighting to tech stocks ever seen in the SPs history. Alongside the dot-com bubble and the housing bubble Orman sees the tech bubble. Only 41 of companies greater than a 250 million market cap had positive EPS last year down from 55 the prior year. And 1970 was when inflation finally started to take hold of the economy and investor. But dont fall asleep thinking that it is all sunshine and rainbows for stocks SPY.

Source: pinterest.com

Source: pinterest.com

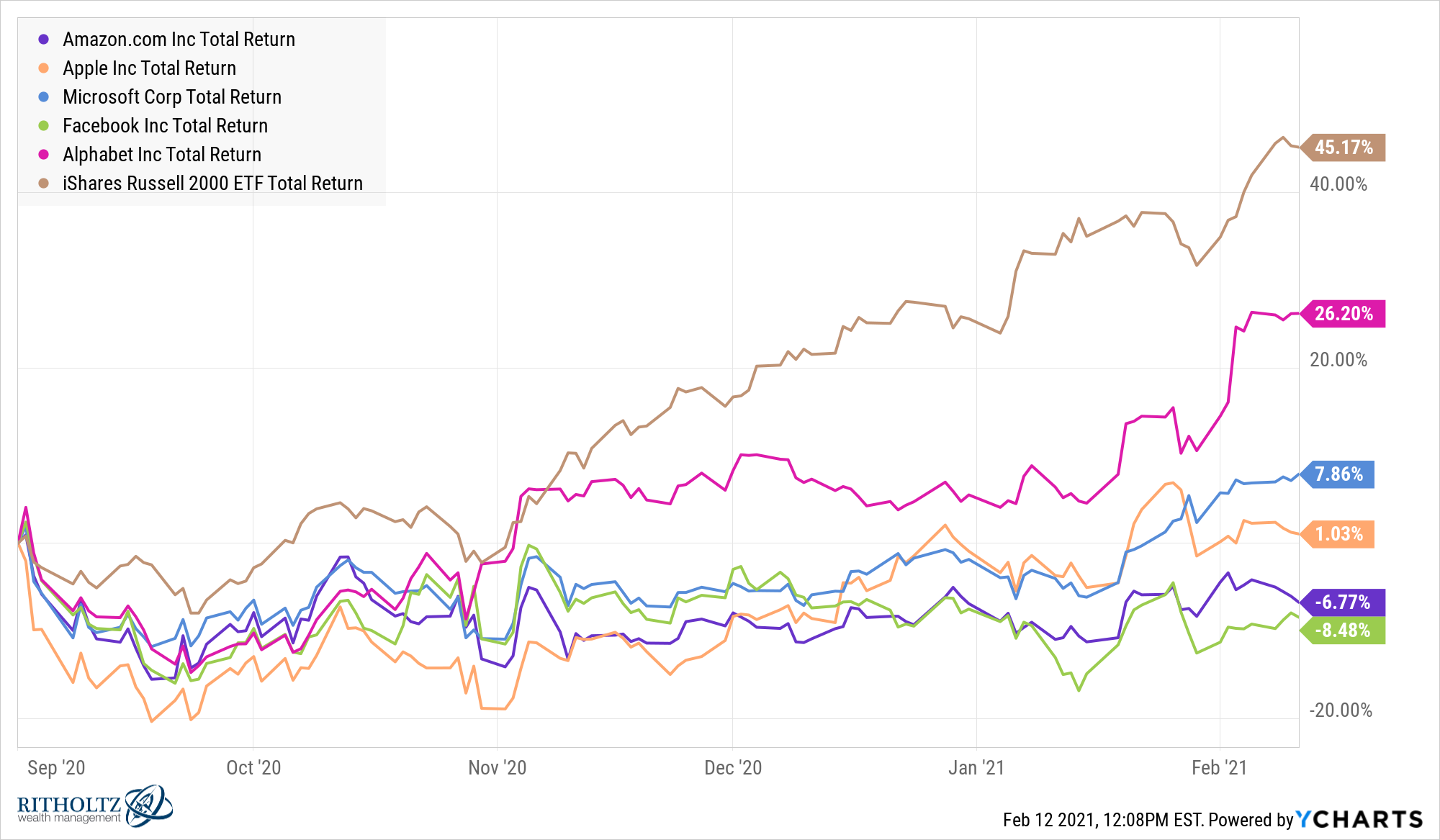

The 10 largest by market value are. The economist and strategist cites crowded trades amid a. Similarly many static or strategic portfolios will also suffer and experience substantial declines because of their inability to adaptthey will reflect what the broad markets experience. That should have longtime market. Messamore in Markets News Opinions Opinion May 7 2020 735 AM The Russell 3000 growth to value ratio is about to cross its peak level during the tech bubble in another bearish sign for the stock market.

Source: quora.com

The inevitable bear market that will follow the current bull market could mean that buying opportunities are more favorable further down the line. And that bubble he argued was most inflated in the Nasdaq 100 the tech-heavy stock index whose biggest components include Apple Amazon. The black line 2020 is clearly an outlier. It was the fastest bear market ever. A bear market is when prices of securities fall sharply and a sweeping negative view causes the sentiment to further entrench itself.

Source: tradingview.com

This time around technology stocks continue to have an outside influence on the markets performance relative to the average sector but I believe it is not just sector weighting but in fact more of a market capitalization issue driven by record buybacks in the USs. I am not saying VTV outperforms in every recession or bear market in stocks. Messamore in Markets News Opinions Opinion May 7 2020 735 AM The Russell 3000 growth to value ratio is about to cross its peak level during the tech bubble in another bearish sign for the stock market. That should have longtime market. And 1970 was when inflation finally started to take hold of the economy and investor.

Source: ccn.com

Source: ccn.com

Only 41 of companies greater than a 250 million market cap had positive EPS last year down from 55 the prior year. This time around technology stocks continue to have an outside influence on the markets performance relative to the average sector but I believe it is not just sector weighting but in fact more of a market capitalization issue driven by record buybacks in the USs. There was NOT a tech bubble in 2007-08. Messamore in Markets News Opinions Opinion May 7 2020 735 AM The Russell 3000 growth to value ratio is about to cross its peak level during the tech bubble in another bearish sign for the stock market. The black line 2020 is clearly an outlier.

Source: seekingalpha.com

Source: seekingalpha.com

ABNB Snap SNAP MercadoLibre MELI Twilio TWLO Atlassian TEAM Pinterest PINS. The economist and strategist cites crowded trades amid a. I am not saying VTV outperforms in every recession or bear market in stocks. Thats both good and bad news for investors who were traumatized by the fastest bear market back in March. The stock market valuation is worth more than twice as much as the GDP which is higher than during the tech bubble as shown by the chart.

Source: awealthofcommonsense.com

Source: awealthofcommonsense.com

The dot-com bubble also known as the dot-com boom the tech bubble and the Internet bubble was a stock market bubble caused by excessive speculation of Internet-related companies in the late 1990s a period of massive growth in the use and adoption of the Internet. The economist and strategist cites crowded trades amid a. Robert Schiller and Fed Chairman Alan Greenspan both called the tech bubble in 1996. The divergence during the tech bubble was caused by the most extreme weighting to tech stocks ever seen in the SPs history. And that bubble he argued was most inflated in the Nasdaq 100 the tech-heavy stock index whose biggest components include Apple Amazon.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tech bubble bear market by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.