20++ Hcl tech debt equity ratio ideas

Home » techno idea » 20++ Hcl tech debt equity ratio ideasYour Hcl tech debt equity ratio images are available. Hcl tech debt equity ratio are a topic that is being searched for and liked by netizens today. You can Find and Download the Hcl tech debt equity ratio files here. Find and Download all free photos and vectors.

If you’re searching for hcl tech debt equity ratio pictures information connected with to the hcl tech debt equity ratio interest, you have visit the ideal blog. Our website always gives you suggestions for refferencing the highest quality video and image content, please kindly search and find more informative video content and images that match your interests.

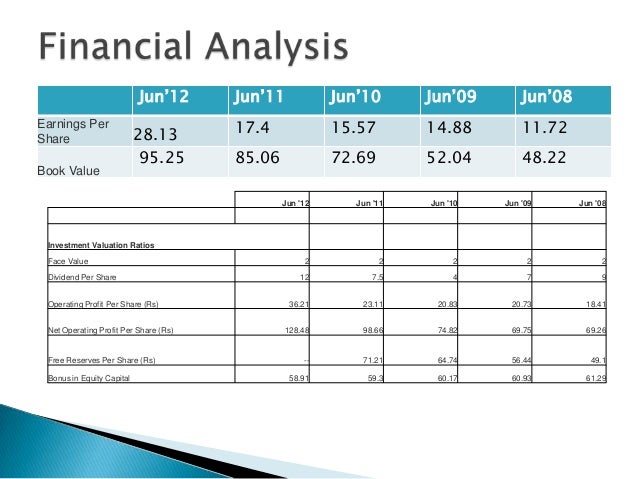

Hcl Tech Debt Equity Ratio. A company which has high debt in comparison to its net worth has to spend a large part of its profit in paying off the interest and the principal amount. Basic EPS Rs 4107. Live BSE NSE Charts. Per Share Ratios.

Biggest Indian It Deal Hcl Tech Buys Select Assets Of Ibm For 1 8 Billion The Financial Express From financialexpress.com

Biggest Indian It Deal Hcl Tech Buys Select Assets Of Ibm For 1 8 Billion The Financial Express From financialexpress.com

DEBT EQUITY RATIO 000 chg. Higher is better Debt to equity ratio. Interest coverage ratio is above its 5 years average which shows companys financial cost burden has increased as percentage. Get HCL TECHNOLOGIES financial statistics and ratios. Therefore this category gets 5 stars in HCL Tech Fundamental Analysis. Key Financial Ratios of HCL Technologies in Rs.

The financial leverage and debt to equity have also been reducing over the years which indicates good levels of solvency.

Higher is better Debt to equity ratio. This indicates good liquidity in the company. Quick Ratiox 162 241 241 231 252 183. HCL TECHNOLOGIES key financial stats and ratios If you want to check out HCLTECH market capitalization PE Ratio EPS ROI and other financial ratios this page is your go-to hub. Has a DE ratio of 000 which means that the company has low proportion of debt in its capital. Debtors Turnover Ratio.

Source: yumpu.com

Source: yumpu.com

Total DebtMcapx 004 003 000 000 001 001. This indicates good liquidity in the company. Key Financial Ratios of HCL Technologies in Rs. Therefore this category gets 5 stars in HCL Tech Fundamental Analysis. The Balance Sheet Page of HCL Technologies Ltd.

Source: slideshare.net

Source: slideshare.net

Ratios Financial summary of HCL Tech HCL Tech Profit Loss Cash Flow Ratios Quarterly Half-Yearly Yearly financials info of HCL Tech. Basic EPS Rs 3222. Financial Stability Ratios. The Balance Sheet Page of HCL Technologies Ltd. 70276 determined based on Median of the 3 historical models.

Source: quora.com

Total Assets Turnover Ratio. Higher is better Debt to equity ratio. This can result in volatile earnings as a result of the additional interest expense. Debtors Turnover Ratio. HCL Technologiess debt to equity for the quarter that ended in Mar.

Source: 36guide-ikusei.net

Source: 36guide-ikusei.net

Interest coverage ratio is above its 5 years average which shows companys efficiency in reducing their financial as percentage of gross profit. Higher is better Debt to equity ratio. Fixed Assets Turnover Ratio. Basic EPS Rs 4107. Fair Value Median EV EBIDTA Model.

Source: blog.investyadnya.in

Source: blog.investyadnya.in

A high debt equity ratio is a bad sign for the safety of investment. A high debt equity ratio is a bad sign for the safety of investment. Total DebtMcapx 004 003 000 000 001 001. 2021 was 011. Get HCL TECHNOLOGIES financial statistics and ratios.

Source: in.tradingview.com

Source: in.tradingview.com

Fair Value Median EV EBIDTA Model. Diluted EPS Rs 4107. Get HCL TECHNOLOGIES financial statistics and ratios. Debtors Turnover Ratio. Interest coverage ratio is above its 5 years average which shows companys financial cost burden has increased as percentage.

Source:

Source:

The quick ratio has also seen significant improvement in recent years. 70276 determined based on Median of the 3 historical models. Basic EPS Rs 4107. Diluted EPS Rs 4107. Has a DE ratio of 000 which means that the company has low proportion of debt in its capital.

Source: 36guide-ikusei.net

Source: 36guide-ikusei.net

A company which has high debt in comparison to its net worth has to spend a large part of its profit in paying off the interest and the principal amount. Per Share Ratios. The financial leverage and debt to equity have also been reducing over the years which indicates good levels of solvency. HCL Technologiess debt to equity for the quarter that ended in Mar. The Balance Sheet Page of HCL Technologies Ltd.

Source: financialexpress.com

Source: financialexpress.com

Good Revenue growth for last 3 years with Avg of 1906. Interest Coverx 2868 7354 16058 11943 9621 10094. Good current ratio of 169. Financial Stability Ratios. Has a ROE of 2648.

Source: slideshare.net

Source: slideshare.net

Financial Stability Ratios. - It is a good metric to check out the capital structure along with its performance. Total DebtMcapx 004. Higher is better Debt to equity ratio. The Balance Sheet Page of HCL Technologies Ltd.

Source: researchgate.net

Source: researchgate.net

Quick Ratiox 162 241 241 231 252 183. If the debt is decreasing over a period of time it. 5373—–Fixed Assets Turnover Ratio. Interest coverage ratio is above its 5 years average which shows companys financial cost burden has increased as percentage. Quick Ratiox 162 241 241 231 252 183.

Source: 36guide-ikusei.net

Source: 36guide-ikusei.net

Per Share Ratios. Dividend payout Ratio Net Profit 000. Higher is better Debt to equity ratio. This can result in volatile earnings as a result of the additional interest expense. If the debt is decreasing over a period of time it.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title hcl tech debt equity ratio by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.