15++ Etf tech bubble information

Home » techno idea » 15++ Etf tech bubble informationYour Etf tech bubble images are available. Etf tech bubble are a topic that is being searched for and liked by netizens now. You can Find and Download the Etf tech bubble files here. Get all royalty-free photos and vectors.

If you’re looking for etf tech bubble pictures information related to the etf tech bubble interest, you have pay a visit to the right blog. Our site frequently provides you with hints for seeing the maximum quality video and image content, please kindly search and locate more enlightening video articles and graphics that match your interests.

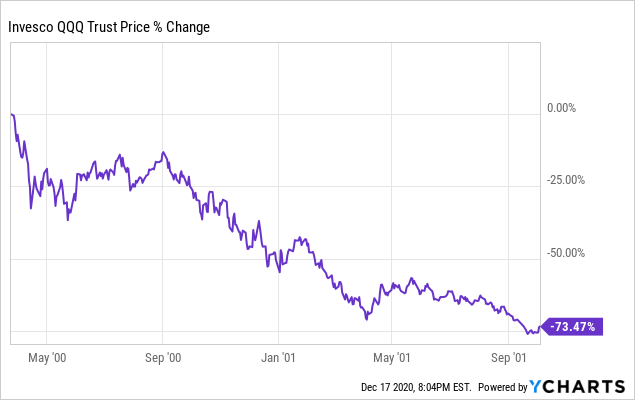

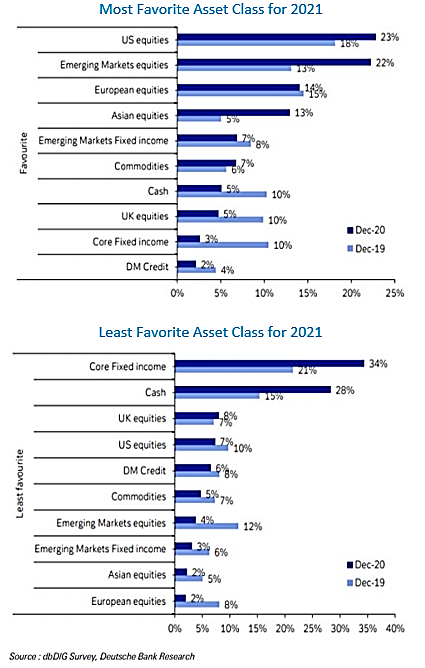

Etf Tech Bubble. This year technology is a leading market trend again and semiconductors continue to outperform. This actively managed ETF offers investors a sound short vehicle for the next tech bubble burst. Tax cuts may unleash 25 trillion in buybacks dividends and MA this year. The current PB valuations for growth companies are on par with the tech-bubble period of two decades ago.

A Tech Bubble Tech Could Be Undervalued Seeking Alpha From seekingalpha.com

A Tech Bubble Tech Could Be Undervalued Seeking Alpha From seekingalpha.com

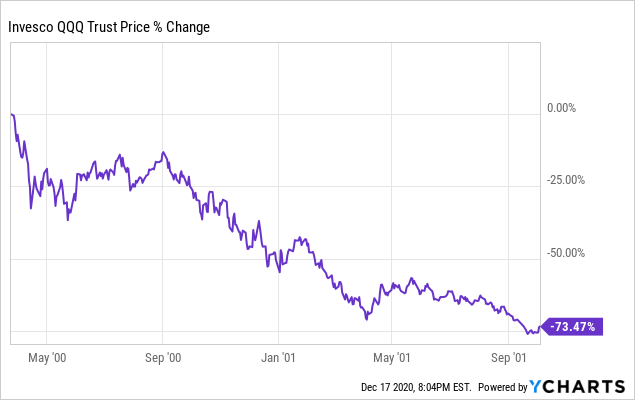

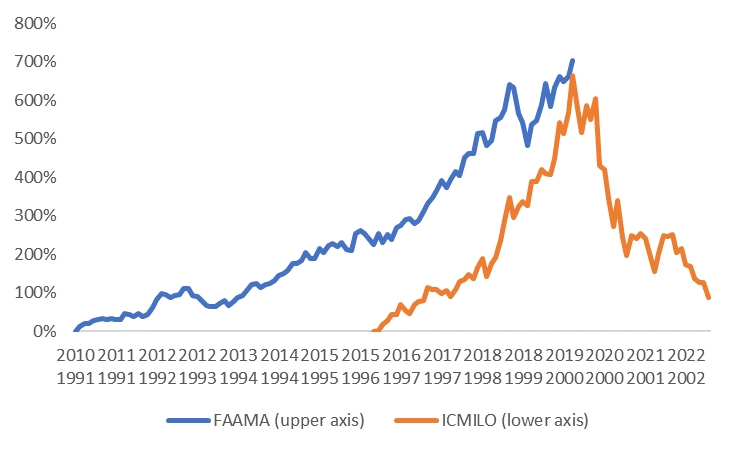

Wider bubbles are much rarer occurrences. Much of the debate around disruptive technology has been centered around bubbles. The internet bubble burst when the Fed tightened monetary policy and many leading tech companies sold their stocks. In a research note entitled Passive Attack Jurassic Park and the Nasdaq Bubble Deluard pictured said the ETF industry was instead overwhelmingly allocating capital to giant tech stocks which ran the risk of creating a self-reinforcing loop of market losses and outflows if sentiment reversed. Here is a standard chart of an asset bubble. The only other time when a sector has been that large was back in 2000 which we now know was a bubble.

The tech bubble in 19992000 falls into this category.

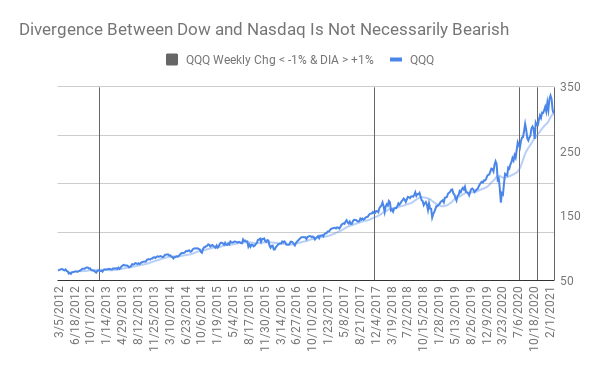

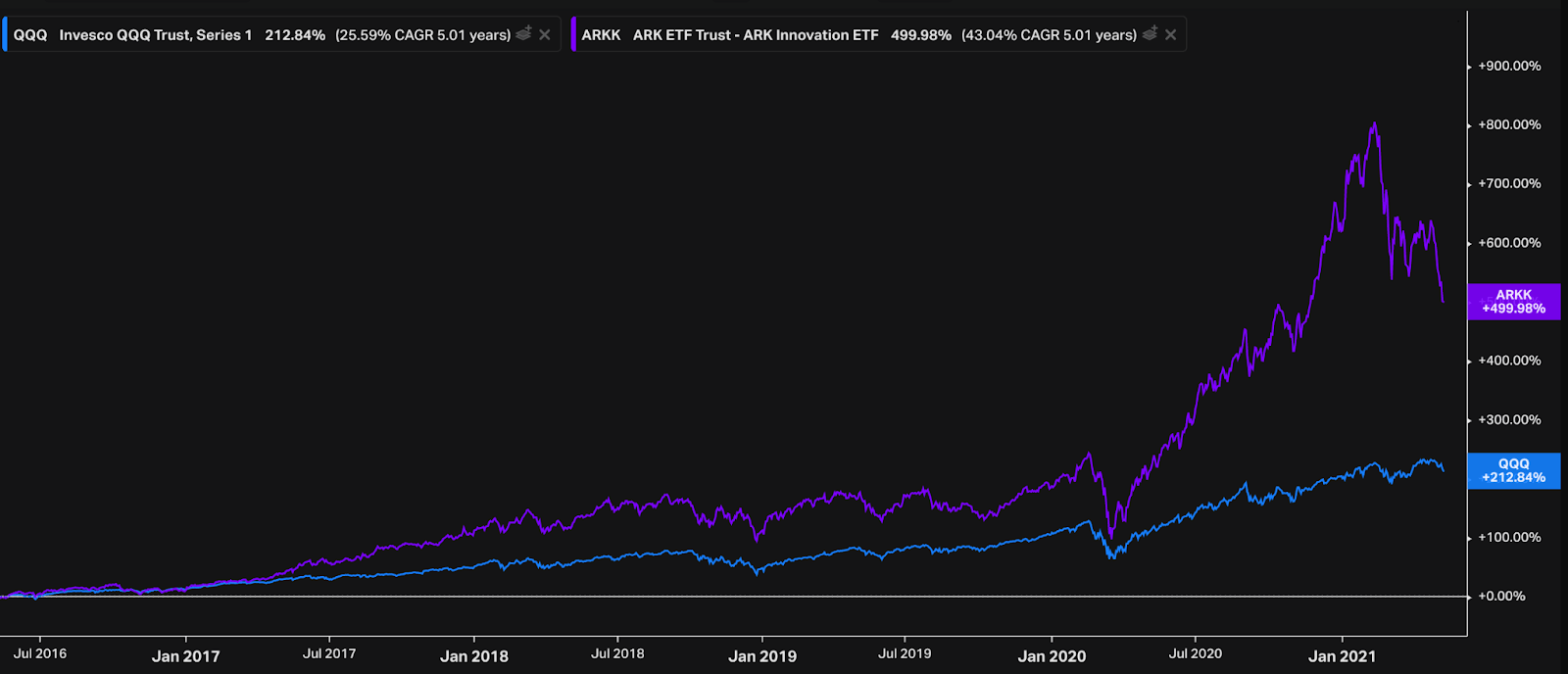

The market movements we are seeing today have. Last October and November ETF PM reported that we expect a tech mega bubble ahead. Wider bubbles are much rarer occurrences. Amazon Apple and Microsoft which make up. The ARK Innovation ETF holds some of the most bubbly stocks and serves as a great early indicator of how the bubble is faring. The market movements we are seeing today have.

Source: seekingalpha.com

Source: seekingalpha.com

Insider logo The word Insider. The market movements we are seeing today have. The current PB valuations for growth companies are on par with the tech-bubble period of two decades ago. Current prices crossed above its 10. The key question is whether ETFs like those run by Ark Invest are in the Awareness Phase or already in the Blow Off Phase.

Source: seekingalpha.com

Source: seekingalpha.com

Relative volatility of Momentum was much higher then December 1998-December 2000 than it is now with an annualized standard deviation of daily relative returns of 159almost double the current periods standard deviation of 81 December 2018-December 2020 notes SP. The current PB valuations for growth companies are on par with the tech-bubble period of two decades ago. The market movements we are seeing today have. When the bubble inevitably bursts ETF investors who gained so richly as the bubble inflated will be the first feel the burn a provocative new white paper has claimed. Current prices crossed above its 10.

Source: seekingalpha.com

Source: seekingalpha.com

Insider logo The word Insider. Investors are increasingly flocking to ETFs like the SPDR SP 500 SPY and Invesco QQQ QQQ which both have a heavy concentration in a handful of tech companies. Tax cuts may unleash 25 trillion in buybacks dividends and MA this year. Adding to the case for PTF is that momentum isnt as volatile today as it was during the 2000 tech bubble. Last October and November ETF PM reported that we expect a tech mega bubble ahead.

Current prices crossed above its 10. This actively managed ETF offers investors a sound short vehicle for the next tech bubble burst. Wider bubbles are much rarer occurrences. Amazon Apple and Microsoft which make up. Rgard64 The tech bubble refers to the speculative fever and hot money flowing into tech stocks and ARKKSPACs are good examples.

Source: seekingalpha.com

Source: seekingalpha.com

Investors are increasingly flocking to ETFs like the SPDR SP 500 SPY and Invesco QQQ QQQ which both have a heavy concentration in a handful of tech companies. This actively managed ETF offers investors a sound short vehicle for the next tech bubble burst. ETFs investors are blindly buying into the tech bubble causing the tech bubble to inflate further. Tax cuts may unleash 25 trillion in buybacks dividends and MA this year. Rgard64 The tech bubble refers to the speculative fever and hot money flowing into tech stocks and ARKKSPACs are good examples.

Source: ii.co.uk

Source: ii.co.uk

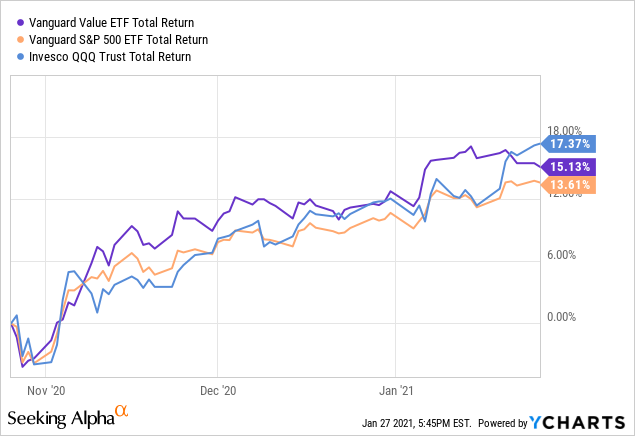

That is what we mean by the Second Tech Bubble. Valuations for VTV equities are in a different universe than the high-flying QQQ ETF stocks. Wider bubbles are much rarer occurrences. Tax cuts may unleash 25 trillion in buybacks dividends and MA this year. The key question is whether ETFs like those run by Ark Invest are in the Awareness Phase or already in the Blow Off Phase.

Source: seekingalpha.com

Source: seekingalpha.com

Rgard64 The tech bubble refers to the speculative fever and hot money flowing into tech stocks and ARKKSPACs are good examples. Valuations for VTV equities are in a different universe than the high-flying QQQ ETF stocks. We thought of having a. Here are some reasons why we are preparing our clients for a tech mega bubble. If 2021 is the year for Tech Bubble 20 to burst owning Vanguard Value will be a better idea than.

Source: etfdailynews.com

Source: etfdailynews.com

Relative volatility of Momentum was much higher then December 1998-December 2000 than it is now with an annualized standard deviation of daily relative returns of 159almost double the current periods standard deviation of 81 December 2018-December 2020 notes SP. When the bubble inevitably bursts ETF investors who gained so richly as the bubble inflated will be the first feel the burn a provocative new white paper has claimed. We thought of having a. Even though ARK Invest probably has the best-known ETFs ARKK ARKG ARKW ARKQ ARKF ARKX out there for the world of disruptive technology QQQ offers investors some exposure to. Much of the debate around disruptive technology has been centered around bubbles.

Source: etftrends.com

Source: etftrends.com

In a research note entitled Passive Attack Jurassic Park and the Nasdaq Bubble Deluard pictured said the ETF industry was instead overwhelmingly allocating capital to giant tech stocks which ran the risk of creating a self-reinforcing loop of market losses and outflows if sentiment reversed. ETFs investors are blindly buying into the tech bubble causing the tech bubble to inflate further. The market movements we are seeing today have. This year technology is a leading market trend again and semiconductors continue to outperform. No two markets are exactly the same but the investor psychology that impacts the markets behavior can be very similar.

Source: seekingalpha.com

Source: seekingalpha.com

Chart 1 shows current PB valuations for growth companies left axis in orange and for value companies right axis in blue. The only other time when a sector has been that large was back in 2000 which we now know was a bubble. Our 4 shortlisted China Tech ETFs are Invesco China Technology ETF CQQQ US Global X MSCI China Information Technology ETF CHIK US KraneShares CSI China Internet ETF KWEB US iShares Hang Seng TECH ETF 3067 HK. Even though ARK Invest probably has the best-known ETFs ARKK ARKG ARKW ARKQ ARKF ARKX out there for the world of disruptive technology QQQ offers investors some exposure to. Rgard64 The tech bubble refers to the speculative fever and hot money flowing into tech stocks and ARKKSPACs are good examples.

Source: etftrends.com

Source: etftrends.com

Much of the debate around disruptive technology has been centered around bubbles. If 2021 is the year for Tech Bubble 20 to burst owning Vanguard Value will be a better idea than. Amazon Apple and Microsoft which make up. Rgard64 The tech bubble refers to the speculative fever and hot money flowing into tech stocks and ARKKSPACs are good examples. Last October and November ETF PM reported that we expect a tech mega bubble ahead.

Source: etfdailynews.com

Source: etfdailynews.com

If 2021 is the year for Tech Bubble 20 to burst owning Vanguard Value will be a better idea than. As this ETF received massive inflows the bubble inflated. The key question is whether ETFs like those run by Ark Invest are in the Awareness Phase or already in the Blow Off Phase. Much of the debate around disruptive technology has been centered around bubbles. Even though ARK Invest probably has the best-known ETFs ARKK ARKG ARKW ARKQ ARKF ARKX out there for the world of disruptive technology QQQ offers investors some exposure to.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title etf tech bubble by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.