10++ David einhorn tech bubble letter information

Home » techno Info » 10++ David einhorn tech bubble letter informationYour David einhorn tech bubble letter images are ready. David einhorn tech bubble letter are a topic that is being searched for and liked by netizens today. You can Get the David einhorn tech bubble letter files here. Find and Download all free photos.

If you’re searching for david einhorn tech bubble letter pictures information linked to the david einhorn tech bubble letter interest, you have come to the right site. Our website always gives you suggestions for viewing the highest quality video and picture content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

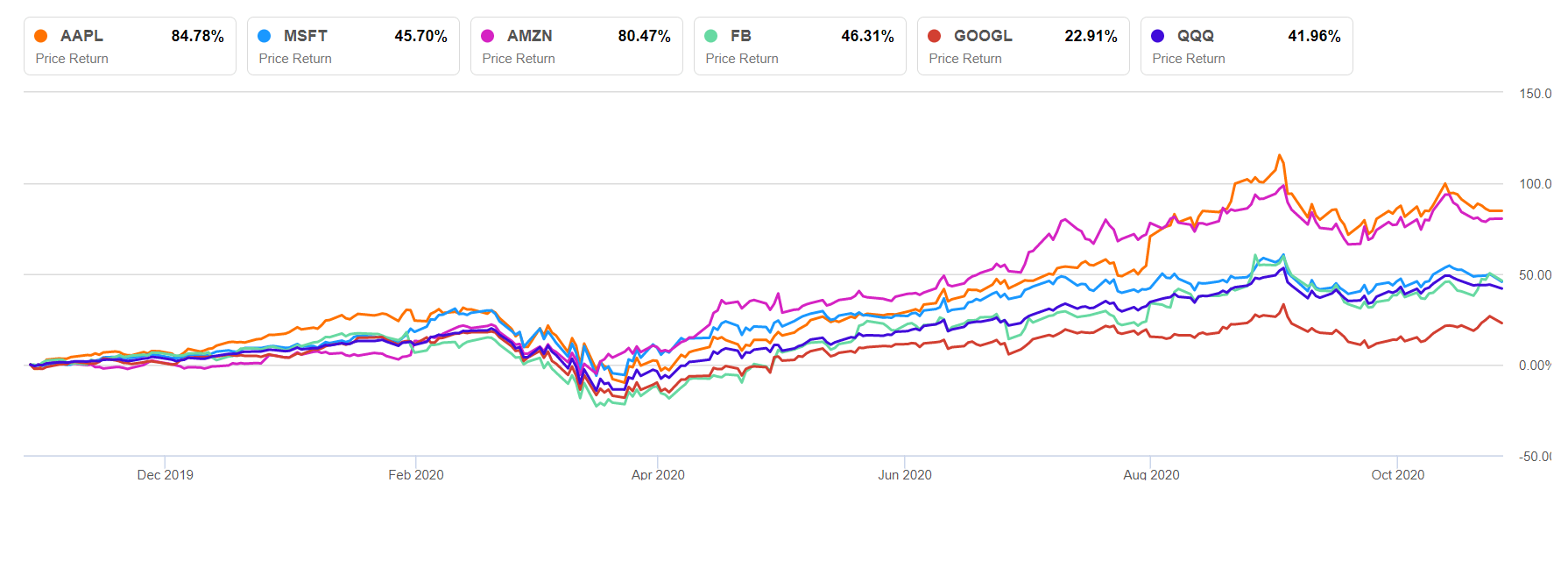

David Einhorn Tech Bubble Letter. Bloomberg – Technology stocks are in an enormous bubble Greenlight Capitals David Einhorn said in a letter to investors. David Einhorns Greenlight Capital has given up on its technology shorts covering its infamous bubble basket at a moderate loss according to its fourth-quarter letter. As for the question of sanity we are now in the midst of an enormous tech bubble. David Einhorns third-quarter letter drew attention for the famed investors assertion that we are in the middle of an enormous tech bubble But the hedge fund managers unveiling of.

Bloomberg – Technology stocks are in an enormous bubble Greenlight Capitals David Einhorn said in a letter to investors. Bloomberg – Technology stocks are in an enormous bubble Greenlight Capitals David Einhorn said in a letter to investors. Einhorn a hedge fund manager at Greenlight Capital warned of a second tech bubble in his first quarter investor letter read in full here. David Einhorn letter. Einhorn who runs Greenlight Capital wrote in a letter we are in the midst of an enormous tech bubble but noted September 2 2020 was the top and the bubble has already popped Reuters saw a copy of the letter. David Einhorns third-quarter letter drew attention for the famed investors assertion that we are in the middle of an enormous tech bubble But the hedge fund managers unveiling of.

It was Einhorns fourth straight positive month.

David Einhorns Greenlight Capital has given up on its technology shorts covering its infamous bubble basket at a moderate loss according to its fourth-quarter letter. Hedge fund manager David Einhorn. In early 2016 he prematurely identified what we thought was a bubble he wrote in the letter. For those who have not followed David Einhorns crusade against central bank money printing and the epic bubble these cluless academic hacks have created his views on the enormous tech bubble we are currently living through and published in his latest letter to investors of his Greenlight hedge fund which returned 59 in Q3 will provide. Einhorn a hedge fund manager at Greenlight Capital warned of a second tech bubble in his first quarter investor letter read in full here. Market skeptics see other signs of a possible bubble.

Source: cnbc.com

Source: cnbc.com

Its been a difficult road for. Greenlight Capitals David Einhorn warns about a bubble in technology and also the perilous political climate in the US. Greenlights October return pared this years losses to 96 according to an investor update viewed by Bloomberg. In its third. In his latest Q3 2020 Letter David Einhorn discusses why he believes September 2 2020 was the top and the bubble has already popped which means investor sentiment is in the process of shifting from greed to complacency.

Source: forbes.com

Source: forbes.com

In his latest Q3 2020 Letter David Einhorn discusses why he believes September 2 2020 was the top and the bubble has already popped which means investor sentiment is in the process of shifting from greed to complacency. Einhorn warns about enormous tech bubble in latest letter. Hedge fund manager David Einhorn. We are now in the midst of an enormous tech bubble Einhorn told investors in a letter this week saying he had added a set of bets against mostly second-tier. Greenlights October return pared this years losses to 96 according to an investor update viewed by Bloomberg.

Source: businessinsider.in

Source: businessinsider.in

An enormous bubble in tech stocks likely popped in September putting the top in the market hedge-fund manager David Einhorn warned in a letter to investors. This isnt the first time Einhorn has flagged a tech bubble. We are now in the midst of an enormous tech bubble Einhorn told investors in a letter this week saying he had added a set of bets against mostly second-tier. Market skeptics see other signs of a possible bubble. Einhorn a hedge fund manager at Greenlight Capital warned of a second tech bubble in his first quarter investor letter read in full here.

David Einhorn letter. In early 2016 he prematurely identified what we thought was a bubble he wrote in the letter. Market skeptics see other signs of a possible bubble. This isnt the first time Einhorn has flagged a tech bubble. In his latest Q3 2020 Letter David Einhorn discusses why he believes September 2 2020 was the top and the bubble has already popped which means investor sentiment is in the process of shifting from greed to complacency.

Source: pragcap.com

Source: pragcap.com

In early 2016 he prematurely identified what we thought was a bubble he wrote in the letter. We are now in the midst of an enormous tech bubble Einhorn told investors in a letter this week saying he had added a set of bets against mostly second-tier. Our working hypothesis which might be disproven is that September 2 2020 was the top and the bubble has already popped he wrote in the Oct. As for the question of sanity we are now in the midst of an enormous tech bubble. Hedge fund manager David Einhorn.

Source: financialpost.com

Source: financialpost.com

This isnt the first time Einhorn has flagged a tech bubble. Greenlights October return pared this years losses to 96 according to an investor update viewed by Bloomberg. Hedge fund manager David Einhorn. An enormous bubble in tech stocks likely popped in September putting the top in the market hedge-fund manager David Einhorn warned in a letter to investors. Einhorn who runs Greenlight Capital wrote in a letter we are in the midst of an enormous tech bubble but noted September 2 2020 was the top and the bubble has already popped.

Our working hypothesis which might be disproven is that September 2 2020 was the top and the bubble has already popped he wrote in the Oct. David Einhorns Greenlight Capital has given up on its technology shorts covering its infamous bubble basket at a moderate loss according to its fourth-quarter letter. Greenlights October return pared this years losses to 96 according to an investor update viewed by Bloomberg. A spokesman for the firm declined to comment. Market skeptics see other signs of a possible bubble.

In early 2016 he prematurely identified what we thought was a bubble he wrote in the letter. Heres an excerpt from the letter. We are now in the midst of an enormous tech bubble Einhorn told investors in a letter this week saying he had added a set of bets against mostly second-tier. In its third. In early 2016 he prematurely identified what we thought was a bubble he wrote in the letter.

Our working hypothesis which might be disproven is that. Market skeptics see other signs of a possible bubble. Einhorn who runs Greenlight Capital wrote in a letter we are in the midst of an enormous tech bubble but noted September 2 2020 was the top and the bubble has already popped. This isnt the first time Einhorn has flagged a tech bubble. For those who have not followed David Einhorns crusade against central bank money printing and the epic bubble these cluless academic hacks have created his views on the enormous tech bubble we are currently living through and published in his latest letter to investors of his Greenlight hedge fund which returned 59 in Q3 will provide.

Source: seekingalpha.com

Source: seekingalpha.com

For those who have not followed David Einhorns crusade against central bank money printing and the epic bubble these cluless academic hacks have created his views on the enormous tech bubble we are currently living through and published in his latest letter to investors of his Greenlight hedge fund which returned 59 in Q3 will provide. A spokesman for the firm declined to comment. David Einhorns Greenlight Capital has given up on its technology shorts covering its infamous bubble basket at a moderate loss according to its fourth-quarter letter. In his latest Q3 2020 Letter David Einhorn discusses why he believes September 2 2020 was the top and the bubble has already popped which means investor sentiment is in the process of shifting from greed to complacency. David Einhorns third-quarter letter drew attention for the famed investors assertion that we are in the middle of an enormous tech bubble But the hedge fund managers unveiling of.

Source: thestreet.com

Source: thestreet.com

Our working hypothesis which might be disproven is that September 2 2020 was the top and the bubble has already popped he wrote in the Oct. Einhorn a hedge fund manager at Greenlight Capital warned of a second tech bubble in his first quarter investor letter read in full here. This isnt the first time Einhorn has flagged a tech bubble. Its been a difficult road for. A deli valued at 100 million is proof the market is fractured.

Source: seekingalpha.com

Source: seekingalpha.com

An enormous bubble in tech stocks likely popped in September putting the top in the market hedge-fund manager David Einhorn warned in a letter to investors. This isnt the first time Einhorn has flagged a tech bubble. David Einhorns Greenlight Capital has given up on its technology shorts covering its infamous bubble basket at a moderate loss according to its fourth-quarter letter. Market skeptics see other signs of a possible bubble. In his latest Q3 2020 Letter David Einhorn discusses why he believes September 2 2020 was the top and the bubble has already popped which means investor sentiment is in the process of shifting from greed to complacency.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title david einhorn tech bubble letter by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.